Who Sells Pet Insurance In 2024? | Comprehensive Guide

Pet owners often find themselves pondering the question, “Who sells pet insurance?” As our furry companions become integral parts of our families, their health and well-being take center stage. In this article, we will embark on a journey to unravel the mysteries of pet insurance, exploring the options available, the key considerations when choosing a provider, and how pet insurance can be a game-changer for both pets and their owners.

Pet insurance is no longer a niche market. With the increasing costs of veterinary care and the deep emotional connection people share with their pets, insurance for our four-legged friends has become a vital consideration. “Who Sells Pet Insurance?” The surge in demand has led to a multitude of providers entering the market, each offering unique policies and features.

Contents

- 1 Understanding Pet Insurance

- 2 Key Factors to Consider

- 3 Top Providers in the Market

- 4 Cost Analysis

- 5 Customizing Coverage for Your Pet

- 6 Steps to Take in Case of Emergency

- 7 The Future of Pet Insurance

- 8 How Pet Insurance Saved Pets

- 9 Tips for Maximizing Pet Insurance Benefits

- 10 Frequently Ask Questions

- 11 Conclusion

Understanding Pet Insurance

Pet insurance, at its core, is designed to cover veterinary expenses. From routine check-ups to unexpected emergencies, a comprehensive pet insurance policy can provide financial support during times of need. It’s crucial to understand the types of coverage available, ranging from accident-only plans to comprehensive policies that include illness coverage.

Pet insurance is a financial product designed to help cover the costs of veterinary care for pets. Policies typically reimburse a percentage of eligible veterinary expenses, including treatments, surgeries, and medications. Pet owners pay a monthly premium for coverage.

The coverage and costs vary among providers and plans. Comprehensive plans may include accident and illness coverage, while more basic plans may only cover accidents. Some policies also cover preventive care, medications, and alternative therapies.

Pet insurance operates on a reimbursement basis. After paying the veterinarian directly, pet owners submit a claim to the insurance company for reimbursement. Policies may have annual or per-incident deductibles, and reimbursement percentages can range from 70% to 90%.

Factors influencing premiums include the pet’s age, breed, and pre-existing conditions. Coverage for hereditary and congenital conditions may be limited. Waiting periods often apply before coverage takes effect.

Understanding policy terms, coverage limits, and exclusions is crucial. Pet owners should review policy details, including waiting periods, pre-existing condition clauses, and any applicable caps on payouts. Regularly assessing the pet’s health needs ensures an appropriate insurance plan, offering financial peace of mind and access to necessary veterinary care.

Key Factors to Consider

Choosing the right pet insurance involves careful consideration of various factors. The age and breed of your pet, pre-existing conditions, and coverage limitations are pivotal points to ponder. A well-informed decision ensures that your pet gets the necessary care without draining your wallet.

When considering pet insurance, key factors include coverage options, such as accident, illness, and preventive care, alongside associated costs like premiums, deductibles, and reimbursement percentages. Assess the policy’s flexibility, exclusions, and waiting periods, keeping in mind the pet’s age, breed, and existing health conditions.

Consider the provider’s reputation, customer reviews, and financial stability. Look for a policy that aligns with the pet’s specific healthcare needs, including coverage for chronic conditions or hereditary issues. Evaluate if the plan allows freedom in choosing veterinarians and if there are networks or restrictions.

Understanding the claims process, including reimbursement turnaround times, is essential. Finally, be aware of any lifetime or per-incident coverage limits. Careful consideration of these factors ensures a well-informed decision and effective coverage for a beloved pet’s healthcare needs.

Top Providers in the Market

Several reputable companies offer pet insurance, each with its strengths and unique selling points. From industry giants to specialized providers, a comparative analysis can help you find the best fit for your pet’s needs.

Several reputable pet insurance providers lead the market. Nationwide is known for comprehensive coverage and wellness plans. Trupanion offers a straightforward approach with no payout limits. Healthy Paws is praised for its high reimbursement rates and customer satisfaction. Embrace provides customizable plans and covers genetic conditions. Petplan is recognized for its flexible coverage and quick claim processing.

Consider the specifics of each provider, comparing premiums, deductibles, coverage options, and customer reviews. Evaluate their policies for pre-existing conditions, waiting periods, and exclusions. The choice depends on individual preferences, pet health needs, and budget constraints. Thorough research ensures selecting a reliable and suitable pet insurance provider for providing optimal care for your furry companion.

Cost Analysis

Understanding the cost of pet insurance is more than just looking at the monthly premium. Factors such as deductibles, co-pays, and coverage limits contribute to the overall cost. A thorough cost analysis helps in budgeting and ensures you get value for your money.

When analyzing the cost of pet insurance, consider monthly premiums, deductibles, reimbursement percentages, and coverage limits. Higher premiums may offer more comprehensive coverage, but weigh this against potential out-of-pocket costs. Evaluate deductibles, as a higher deductible may lead to lower premiums. Reimbursement percentages impact the amount returned.

Factor in the pet’s age, breed, and pre-existing conditions, as these influence premiums. While a more expensive plan might offer greater coverage, assess whether it meets the pet’s specific healthcare needs. Cost analysis allows for a balanced approach, ensuring the chosen pet insurance provides adequate coverage without unnecessary financial strain.

Customizing Coverage for Your Pet

Pets are unique, and their insurance should reflect that. Many providers allow for customization of coverage based on your pet’s specific needs. This ensures that you’re not paying for unnecessary coverage while still addressing potential health risks.

Customizing coverage for your pet involves tailoring a pet insurance policy to meet specific healthcare needs. Start by assessing the pet’s age, breed, and predispositions to certain conditions. Consider the desired coverage, whether for accidents, illnesses, preventive care, or a combination. Evaluate the level of reimbursement, deductibles, and any coverage limits, aligning them with potential veterinary costs.

For pets with chronic conditions or hereditary issues, choose a plan that provides appropriate coverage. Some policies allow customization with add-ons or optional coverage for specific needs. Flexibility in selecting veterinarians and seeking care without network restrictions can be vital.

Regularly reassess the pet’s health and adjust coverage as needed. By customizing coverage, pet owners ensure their insurance plan is tailored to their companion’s unique health profile, offering peace of mind and effective financial support for veterinary care.

Steps to Take in Case of Emergency

Emergencies can be stressful, and having a plan in place is crucial. Knowing the steps to take and how pet insurance fits into the picture can make a significant difference in the outcome of a health crisis.

In case of a pet emergency, take the following steps:

- Remain Calm: Stay composed to make rational decisions.

- Assess the Situation: Gauge the severity of the emergency and determine if immediate veterinary attention is needed.

- Contact Your Veterinarian: If possible, call your regular vet for guidance or to inform them of the situation.

- Visit an Emergency Clinic: If it’s after hours or your vet is unavailable, locate and visit the nearest 24/7 veterinary emergency clinic.

- Provide Information: Be ready to share your pet’s medical history, current medications, and details about the emergency.

- Transport Safely: Handle your pet gently, using a carrier or securing them appropriately in the car for safe transport.

- Notify Pet Insurance: If you have pet insurance, inform them of the emergency and inquire about the claims process.

- Follow-up Care: After emergency treatment, adhere to any follow-up care instructions and schedule a visit with your regular vet for further evaluation.

Being prepared and acting swiftly can significantly impact the outcome in a pet emergency.

The Future of Pet Insurance

As technology advances and pet care standards evolve, the future of pet insurance looks promising. Anticipated changes include more personalized coverage options, advancements in telemedicine for pets, and increased awareness about the importance of preventive care.

The future of pet insurance is likely to see continued growth and evolution. Advancements in veterinary care may lead to increased demand for comprehensive coverage, including advanced treatments and therapies. Personalized plans tailored to individual pets’ health profiles may become more common, with insurers leveraging data and technology for accurate risk assessment.

As pet owners increasingly prioritize preventive care, policies covering wellness services may become more prevalent. Collaboration between insurers and veterinary practices may streamline the claims process, enhancing customer experience. Additionally, expanding awareness about the benefits of pet insurance may drive market penetration. Overall, the future holds opportunities for enhanced coverage, improved accessibility, and a more sophisticated approach to meeting the diverse healthcare needs of beloved pets.

How Pet Insurance Saved Pets

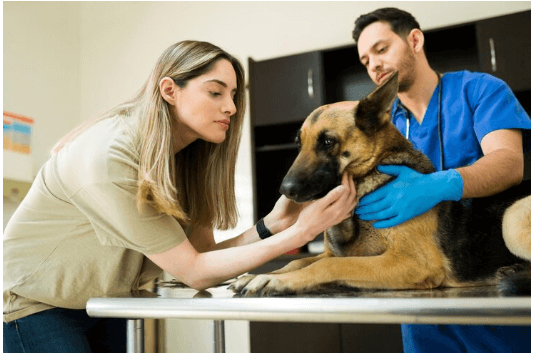

Nothing speaks louder than real-life stories. Hearing about pets whose lives were saved, thanks to timely and comprehensive insurance coverage, adds a personal touch to the decision-making process. Pet insurance has been instrumental in saving countless pets by providing financial support for necessary veterinary care. With rising healthcare costs, pet insurance enables owners to afford critical treatments, surgeries, and medications that might otherwise be financially burdensome.

This financial safety net encourages prompt medical attention, improving the chances of successful outcomes in emergencies or illnesses. The ability to choose comprehensive coverage, including preventive care, encourages regular veterinary visits, contributing to early detection of health issues and proactive treatment. Pet insurance has played a crucial role in reducing euthanasia rates due to economic constraints, allowing pet owners to make medical decisions based on the best interests of their pets rather than financial limitations. As the popularity and awareness of pet insurance grow, more pets benefit from timely and quality healthcare, contributing to their overall well-being and longevity.

Tips for Maximizing Pet Insurance Benefits

Getting the most out of your pet insurance involves proactive measures. Regular check-ups, preventive care, and understanding your policy’s nuances contribute to maximizing the benefits of pet insurance. Maximize pet insurance benefits by choosing a comprehensive plan that aligns with your pet’s needs. Understand coverage details, including deductibles and reimbursement percentages.

Regularly visit the vet for preventive care, addressing issues before they escalate. Keep thorough records for swift claims processing. Consider adding optional coverage for specific needs. Stay informed about policy updates and communicate promptly with the insurer during emergencies. By making informed decisions and utilizing available benefits, you ensure optimal care for your pet while maximizing the value of your insurance.

Legalities and Fine Print

Pet insurance policies come with legalities and fine print that may seem daunting. Understanding these aspects ensures that you’re aware of the terms and conditions, avoiding surprises when you need to make a claim. Understanding legalities and fine print is crucial in pet insurance. Pay attention to policy terms, exclusions, waiting periods, and pre-existing condition clauses to ensure comprehensive coverage and avoid surprises.

Integrating Wellness Plans

Some pet insurance providers offer wellness plans that go beyond covering illnesses and accidents. Integrating wellness into the insurance plan provides a holistic approach to pet health, emphasizing preventive care. Integrating wellness plans into pet insurance enhances coverage by addressing preventive care needs. These plans often cover routine exams, vaccinations, and screenings, promoting overall pet health and well-being.

Frequently Ask Questions

What is the best type of pet insurance?

Lifetime, This is the most comprehensive type of cover you can get. You pay premiums every year during your pet’s life, and the insurer will have to keep covering you – regardless of age or any existing conditions (subject to conditions).

Where to start with pet insurance?

So how do I get started with getting pet insurance? Pet insurance is a lot like human health insurance. You will need to give your insurer some information about your pet, and then they will give you a quote for how much you will pay based on that information. This quote is for your premium.

Who sells pet insurance?

Pet insurance is sold by various companies, including major insurers like Nationwide, Trupanion, and Petplan, as well as specialized providers like Healthy Paws and Embrace. Veterinary clinics may also offer coverage through partnerships with insurance companies.

What is a pet insurance company?

Whilst pet insurance helps cover the cost of veterinary treatment for unexpected illness or injury, Health Plans help your pet’s routine, preventative healthcare. Depending on which Health Plan you choose, you’ll save money on things like annual vaccinations, flea and worm treatment, and routine health check-ups.

How much is pet insurance a month?

The actual cost can range widely, with lifetime pet insurance for dogs costing anywhere from £10 to £100 a month (£125 to £1,200 a year) or more. These costs are highly variable and depend on factors such as the breed and age of your pet. It’s also important to take into account the different factors.

Conclusion

Finding the right pet insurance requires careful consideration of various factors. From understanding coverage options to analyzing costs and reading customer reviews, the journey to safeguarding your pet’s health is a thoughtful one. As the pet insurance landscape evolves, staying informed and making proactive choices ensures that your furry friend receives the best possible care.