Who Qualifies for Humana Insurance in 2024? | An Affordable Insurance?

Humana Insurance is a well-established healthcare provider that offers a range of insurance products to individuals and families. In this comprehensive article, we will delve into the qualifications and eligibility criteria for Humana Insurance, Who Qualifies for Humana Insurance the different coverage options available, special programs for specific groups, the application process, associated costs, and tips for making the most of your Humana Insurance.

Contents

Understanding Humana Insurance

Humana Insurance is a leading healthcare company in the United States, specializing in health insurance and wellness solutions. With its headquarters in Louisville, Kentucky, Humana focuses on providing a diverse range of health-related services, including Medicare and Medicaid plans, employer-sponsored coverage, and individual health insurance. The company is known for its commitment to holistic well-being, incorporating preventive care and innovative wellness programs into its offerings. Humana’s emphasis on personalized and accessible healthcare makes it a prominent choice for individuals and organizations seeking comprehensive health insurance solutions.

Before we explore who qualifies for Humana Insurance, it’s essential to understand what Humana Insurance offers. Humana is a leading provider of health and wellness services, with a focus on delivering value to its members. Their insurance plans are designed to meet the diverse healthcare needs of individuals and families across the United States.

Humana Insurance eligibility criteria typically depend on the specific plan and coverage being considered. For Medicare plans, individuals usually qualify if they are aged 65 or older or have certain qualifying disabilities. Medicaid plan eligibility is income-based and varies by state. Employer-sponsored plans often require employment or affiliation with a participating organization. Individual health plans may have varying criteria. Checking Humana’s specific plan details and consulting with their representatives can provide accurate and personalized information regarding eligibility requirements.

Eligibility Criteria for Humana Insurance

Eligibility for Humana Insurance is open to individuals of all age groups, making it a versatile option for diverse healthcare needs. For those seeking Medicare coverage, eligibility is primarily based on age, with individuals aged 65 and older qualifying. However, Humana also extends its services to those with disabilities and individuals with specific medical conditions, such as end-stage renal disease.

Additionally, Humana offers individual and family health insurance plans, catering to a wide range of healthcare requirements. Whether you’re a young adult, working professional, senior citizen, or a family seeking comprehensive health coverage, Humana provides options to meet your specific needs.

Age Requirements

Age requirements for Humana Insurance vary based on the type of plan. Medicare plans are generally available for individuals aged 65 or older, or those with qualifying disabilities. Medicaid eligibility is often income-based and may not have specific age restrictions. Employer-sponsored plans may be contingent on employment status, and individual health plans typically have age brackets for enrollment. It’s advisable to review the specific plan details or consult with Humana representatives for accurate and tailored information regarding age requirements.

Medicare Eligibility

Medicare eligibility with Humana is primarily determined by age and specific circumstances. Individuals typically qualify at age 65 or older. Younger individuals with certain disabilities or specific medical conditions may also be eligible. It’s important to note that the eligibility criteria may vary based on individual circumstances and state regulations. Checking with Humana or visiting the official Medicare website can provide precise information regarding eligibility and guide individuals through the enrollment process.

Individual and Family Plans

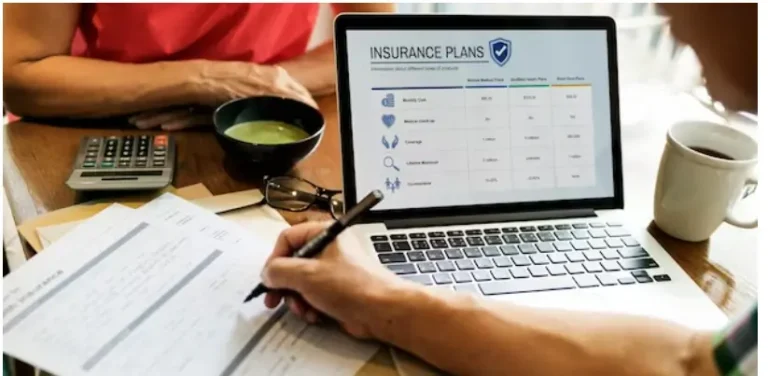

Humana offers a variety of individual and family health insurance plans tailored to meet diverse needs. These plans provide coverage for medical expenses, prescription drugs, and preventive care. Individuals and families can choose from a range of options, including Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans, allowing flexibility in selecting healthcare providers. Humana’s individual and family plans aim to provide comprehensive and accessible healthcare coverage to meet the unique requirements of each policyholder.

Special Programs and Considerations

Humana Insurance incorporates special programs and considerations to enhance the overall health and well-being of its policyholders. These may include wellness initiatives, preventive care services, and resources for managing chronic conditions. Additionally, Humana often integrates perks such as fitness programs, and telehealth.

These special programs reflect a commitment to a holistic approach to healthcare, aiming to go beyond traditional coverage by fostering proactive health management and ensuring a more comprehensive and individualized insurance experience.

- Medicaid and CHIP: For individuals with lower income, Medicaid and the Children’s Health Insurance Program (CHIP) can be options to consider. Humana may participate in these programs in certain states.

- Low-Income Subsidy: For those with limited financial means, the Extra Help program can help cover prescription drug costs under Medicare.

- Veterans and Military Service Members: Humana Insurance may have specific plans and considerations for veterans and military service members, recognizing their unique healthcare needs.

- People with Disabilities: Individuals with disabilities may be eligible for special programs and resources, such as home and community-based services.

Humana Insurance Costs

Humana Insurance incorporates special programs and considerations to enhance the overall health and well-being of its policyholders. These may include wellness initiatives, preventive care services, and resources for managing chronic conditions. Additionally, Humana often integrates perks such as fitness programs, telehealth options, and personalized support.

These special programs reflect a commitment to a holistic approach to healthcare, aiming to go beyond traditional coverage by fostering proactive health management and ensuring a more comprehensive and individualized insurance experience.

Understanding the costs associated with your insurance is crucial. Humana offers a range of plans with varying costs. These costs may include:

- Premiums: The monthly payment you make for your insurance plan.

- Deductibles and Copayments: The out-of-pocket expenses you’ll incur for medical services.

- Out-of-Pocket Maximums: The maximum amount you’ll pay for covered services in a plan year.

- Extra Help and Financial Assistance: If you have limited financial resources, you may qualify for assistance to reduce your healthcare costs.

FAQs about Who Qualifies for Humana Insurance

What are the important eligibility criteria for Medicare?

Medicare eligibility typically requires individuals to be 65 or older, or younger with certain qualifying disabilities. Additionally, individuals of any age with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) may be eligible. U.S. citizenship or legal residency is also a criterion. Specific circumstances can impact eligibility, so it’s advisable to check individual situations for accurate information.

What’s the difference between Medicare and Humana?

Medicare is a federal health insurance program primarily for those 65 and older, while Humana is a private insurance company that offers various health insurance plans, including Medicare Advantage, Medigap, and more. Humana partners with Medicare to provide additional coverage options and benefits.

Does Humana Offer Life Insurance?

Yes, Humana offers life insurance products, including term and whole life insurance. These life insurance plans are designed to provide financial security and support for your loved ones in the event of your passing.

What is the Medicare eligibility age?

The Medicare eligibility age is 65. Individuals qualify for Medicare coverage once they reach this age, and enrollment usually begins three months before the 65th birthday. Younger individuals with certain disabilities or specific medical conditions may also be eligible. U.S. citizenship or legal residency is generally a requirement for eligibility.

Conclusion

Humana Insurance offers a diverse range of insurance products, catering to individuals of various age groups and healthcare needs. Whether you’re looking for traditional health insurance, Medicare coverage, or supplemental plans, Humana has options to explore. To find out if you qualify and to get the coverage that suits you best, consider their eligibility criteria, special programs, and the application process. Maximize your Humana Insurance by understanding your plan, utilizing in-network providers, and taking advantage of their wellness programs. Humana is committed to keeping you and your family healthy and well-insured.