Who Needs Medicare Part B?

Medicare is a vital program that provides health insurance for millions of Americans. It offers different parts, each covering specific aspects of healthcare. In this article, ‘Who Needs Medicare Part B’ we’ll focus on Medicare Part B and who needs it. Understanding the various components of Medicare and its eligibility criteria is essential for making informed healthcare decisions.

Medicare Part B is a critical component of the U.S. healthcare system, designed to cater to the medical needs of seniors and individuals with certain disabilities. It is especially essential for those seeking coverage for doctor’s visits, outpatient care, and preventive services.

This means if you value staying on top of your health and well-being, Medicare Part B is something you should seriously consider. It not only offers you access to a wide range of essential medical services but also provides the flexibility to choose your preferred healthcare providers. So, if you’re wondering who needs Medicare Part B, the answer is clear: anyone who wants comprehensive healthcare coverage and the peace of mind that comes with it.

Contents

- 1 Understanding Medicare

- 2 What is Medicare Part B?

- 3 Eligibility for Medicare Part B

- 4 Enrollment Options

- 5 Benefits of Medicare Part B

- 6 What is covered under Medicare Part B?

- 7 Costs and Premiums

- 8 Medicare Part B vs. Medicare Part A

- 9 The Importance of Supplemental Coverage

- 10 How to Apply for Medicare Part B

- 11 FAQs About Who Needs Medicare Part B

- 12 Conclusion

Understanding Medicare

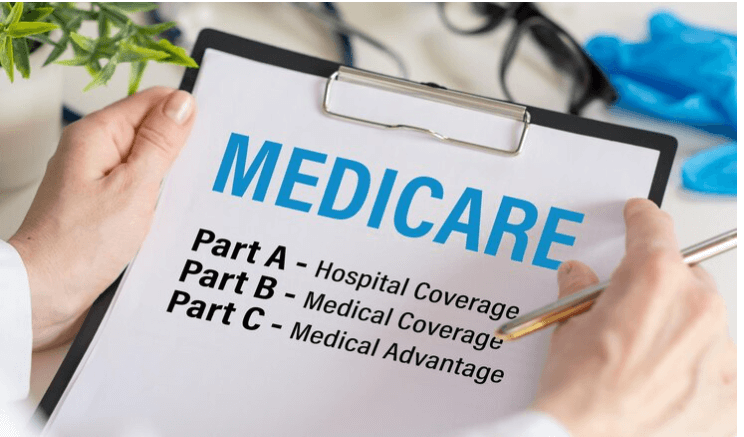

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older. It also serves people with certain disabilities and specific medical conditions. Medicare is divided into several parts, each addressing different healthcare needs. These parts include Medicare Part A, Part B, Part C, and Part D.

Understanding Medicare is essential for anyone navigating the complex world of healthcare in the United States. Medicare is a federal health insurance program primarily designed for seniors aged 65 and older, as well as individuals with certain disabilities.

It consists of several parts, each covering different aspects of healthcare, from hospital stays to doctor’s visits and prescription drugs. Medicare Part A provides coverage for inpatient hospital care, while Medicare Part B covers outpatient services and medical supplies. Additionally, Medicare Part D offers prescription drug coverage.

To make informed decisions about your healthcare, it’s crucial to understand the eligibility requirements, enrollment periods, and the coverage provided by each part of Medicare. With this knowledge, you can select the right plan that suits your specific healthcare needs and financial situation.

What is Medicare Part B?

Medicare Part B is a component of the Medicare program in the United States. It is often referred to as “Medical Insurance.” This part of Medicare primarily covers services and supplies necessary for medical treatment and prevention. These services include doctor’s visits, outpatient care, preventive services, laboratory tests, durable medical equipment, and ambulance services, among others.

Unlike Medicare Part A, which mainly covers inpatient hospital care and is typically premium-free for most beneficiaries, Medicare Part B typically requires a monthly premium. The premium amount may vary depending on factors such as your income.

Medicare Part B is vital for maintaining good health and managing chronic medical conditions, as it covers a wide range of essential medical services. It reduces the financial burden on beneficiaries by paying for a significant portion of their medical expenses. However, it’s important to note that Medicare Part B.

Enrollment in Medicare Part B is typically done during specific enrollment periods, including the Initial Enrollment Period (IEP), which begins three months before your 65th birthday and ends three months after. There’s also a General Enrollment Period from January 1 to March 31 each year, but enrolling during this period can result in late enrollment penalties.

Eligibility for Medicare Part B

Eligibility for Medicare Part B, a key component of the United States’ healthcare system, depends on several factors. To qualify for Medicare Part B, an individual generally needs to meet one of the following criteria:

- Age Requirement: If you are 65 years of age or older, you are typically eligible for Medicare Part B.

- Legal Residency: You must be a U.S. citizen or a legal permanent resident who has lived in the country for at least five continuous years.

- Disability: Individuals under 65 with certain disabilities may also be eligible for Medicare Part B. This typically includes those who have received Social Security Disability Insurance (SSDI) benefits for at least 24 months.

It’s important to note that while these are the general eligibility criteria, there may be exceptions and special circumstances. Ensuring you meet the requirements and understanding when and how to enroll in Medicare Part B is crucial for obtaining the healthcare coverage you need.

Enrollment Options

Enrolling in Medicare Part B can be done during specific enrollment periods. The Initial Enrollment Period (IEP) begins three months before your 65th birthday and ends three months after. There’s also a General Enrollment Period from January 1 to March 31 each year, but this could lead to a late enrollment penalty.

When it comes to enrolling in Medicare Part B, there are a few options available to ensure you get the healthcare coverage you need:

Initial Enrollment Period (IEP)

Your IEP is the primary enrollment opportunity. It typically spans the seven-month period surrounding your 65th birthday, starting three months before your birthday month and ending three months after. During this time, you can enroll in Medicare Part B without incurring any late enrollment penalties.

General Enrollment Period (GEP)

If you miss your Initial Enrollment Period, you have another chance to sign up during the General Enrollment Period. This runs from January 1st to March 31st each year. Keep in mind that enrolling during this period may result in late enrollment penalties, and your coverage won’t begin until July 1st.

Special Enrollment Period (SEP)

Some individuals may qualify for a Special Enrollment Period based on specific life events, such as losing employer-sponsored insurance or moving to a new area. SEPs provide flexibility in enrolling outside the standard enrollment periods.

Automatic Enrollment

If you’re already receiving Social Security or Railroad Retirement Board benefits when you become eligible for Medicare, you’ll typically be automatically enrolled in both Medicare Part A and Part B. You’ll receive your Medicare card in the mail.

Choosing the right enrollment option depends on your individual circumstances. Ensuring you understand these options and meet the deadlines is crucial to avoid potential penalties and to secure timely access to your Medicare Part B coverage.

Benefits of Medicare Part B

Medicare Part B offers a range of essential benefits that are critical for maintaining your health and well-being. Some of the key advantages and benefits of enrolling in Medicare Part B include:

- Doctor’s visits

- Outpatient care

- Preventive services

- Laboratory tests

- Durable medical equipment

- Ambulance services

These benefits ensure that you have access to a wide range of medical services, helping you to maintain your health and address any health concerns that may arise. Understanding the scope of coverage provided by Medicare Part B is crucial in making informed decisions about your healthcare.

What is covered under Medicare Part B?

Medicare Part B covers most of your routine, everyday care essential medical services, and supplies needed for diagnosing and treating medical conditions, including doctor visits, outpatient care, preventive services, durable medical equipment, mental health services, and more. Part A, on the other hand, covers only the care and services you receive during an actual hospital stay. If you happen to use the hospital for your lab work or imaging, those fall under Part B.

We outlined some of the services that are covered under Part B above, and here are a few specifics:

- Ambulance services, such as ground transportation to a hospital

- Durable medical equipment, including wheelchairs, walkers, and hospital beds

- Heart disease screenings

- Cardiac rehabilitation, including exercise, education, and counseling

- Cancer screenings, including those for cervical, vaginal, lung, breast, prostate, and colorectal cancer

- Chemotherapy if you have cancer

- Diabetes care, including equipment and supplies (such as test strips and lancets)

- Some acupuncture and chiropractic services

- Physical therapy

- Screenings for depression, diabetes, hepatitis C, and HIV

- Tests, including X-rays, MRIs, CT scans, and EKGs/ECGs

- Flu shots and other vaccines

- Diabetes-related foot care

- Smoking cessation services

Costs and Premiums

Medicare Part B comes with a monthly premium. The premium amount may vary depending on your income, but it’s essential to enroll when you first become eligible to avoid late enrollment penalties. While the premium is a cost, the coverage can save you money on medical expenses in the long run.

Medicare Part B vs. Medicare Part A

Medicare Part B and Part A serve different purposes. Part A mainly covers inpatient hospital care, skilled nursing facilities, and some home health care. Part B focuses on outpatient and medical services. To get comprehensive Medicare coverage, many beneficiaries opt for both Part A and Part B.

Medicare Part A and Medicare Part B are two essential components of the U.S. government’s Medicare program. These two parts serve different purposes and cover distinct aspects of healthcare.

Medicare Part A, often known as “hospital insurance,” primarily focuses on inpatient care. It covers hospital stays, skilled nursing facilities, and some home healthcare services. Essentially, if you require hospitalization or rehabilitation in a skilled nursing facility, Medicare Part A will provide coverage.

Eligibility for Medicare Part A is typically automatic for individuals aged 65 and older if they or their spouse have paid Medicare taxes for at least ten years. However, those under 65 may also qualify if they have specific disabilities. This part of Medicare is an important safety net for seniors, ensuring they have access to necessary hospital services without the burden of high costs.

Medicare Part B is often referred to as “medical insurance” and deals with outpatient services. Part B covers a wide range of medical services and supplies, including doctor’s visits, preventive care, ambulance services, and durable medical equipment. Essentially, if the healthcare service you require doesn’t involve a hospital stay, it’s likely covered under Medicare Part B.

Eligibility for Medicare Part B is also linked to age, but unlike Part A, enrollment is not automatic. Individuals need to sign up for Part B during specific enrollment periods, and they usually pay a monthly premium for this coverage. Part B is crucial for maintaining overall health and accessing regular medical care.

The Importance of Supplemental Coverage

The importance of supplemental coverage in the context of Medicare, particularly Medicare Part B, cannot be overstated. While Medicare Part B provides valuable medical coverage, it doesn’t cover all healthcare expenses. This is where supplemental coverage, also known as Medigap plans or Medicare Advantage plans, becomes crucial.

Here are some key reasons why supplemental coverage is important:

Filling the Gaps:

Medicare Part B has deductibles, coinsurance, and copayments that beneficiaries are responsible for. These out-of-pocket costs can add up, especially for individuals with frequent medical needs. Supplemental coverage helps fill these financial gaps, reducing the burden on beneficiaries.

Comprehensive Coverage

Medigap plans, for example, are specifically designed to work alongside Medicare. They cover costs that Medicare doesn’t, making your healthcare coverage more comprehensive. This can include coverage for coinsurance, copayments, and deductibles.

Predictable Costs

Supplemental coverage can provide predictable healthcare costs. With Medicare alone, it can be challenging to estimate how much you’ll need to spend on medical expenses. Supplemental plans offer a level of financial predictability by covering various costs.

Choice and Flexibility

Medicare Advantage plans often provide additional benefits beyond what original Medicare offers, such as vision, dental, and prescription drug coverage. These plans offer flexibility and choice in tailoring your healthcare coverage to your specific needs.

Peace of Mind

Knowing that you have supplemental coverage in place can offer peace of mind. It can help you focus on your health and well-being without worrying about unexpected medical bills.

Access to a Wider Network

Some Medicare Advantage plans come with networks of doctors and healthcare providers. This means you can access a broader network of healthcare professionals, potentially increasing your options for care.

How to Apply for Medicare Part B

Applying for Medicare Part B is a straightforward process. You can do it online through the official Medicare website or visit your local Social Security office. Make sure to enroll during your Initial Enrollment Period to avoid any late enrollment penalties.

To apply for Medicare Part B, follow these simple steps:

- Confirm eligibility: Ensure you meet age or disability criteria.

- Know your enrollment period: Apply during your Initial Enrollment Period (around age 65) to avoid penalties.

- Apply online: Visit www.ssa.gov or call 1-800-772-1213 to complete the application.

- Visit in person: Schedule an appointment at your local Social Security office and bring the necessary documents.

- Automatic enrollment: If already receiving Social Security benefits, you’ll be enrolled automatically.

- Special Enrollment Periods: You may qualify for SEPs based on specific life events.

- Follow deadlines: Missing enrollment periods may result in higher premiums.

- Wait for your Medicare card: Once approved, your Medicare card will be sent to you.

FAQs About Who Needs Medicare Part B

Does a person really need Medicare Part B?

Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.

Who is entitled to Medicare Part B?

Be age 65 or older; Be a U.S. resident; AND. Be either a U.S. citizen OR. Be an alien who has been lawfully admitted for permanent residence and has been residing in the United States for 5 continuous years prior to the month of filing an application for Medicare.

What is Medicare Part B used for?

Medicare Part B helps cover medically necessary services like doctors’ services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services.

What happens if I don’t want Medicare Part B?

You can voluntarily terminate your Medicare Part B (Medical Insurance). However, you may need to have a personal interview with us to review the risks of dropping coverage and for assistance with your request.

Is Medicare Part B mandatory at age 65?

After turning 65, you can delay enrolling in Medicare Part B (and avoid paying its premiums) for as long as you are covered under a group health plan provided by an employer for which you or your spouse actively works. (Note that “active” is the keyword here.

Conclusion

Medicare Part B is a valuable component of the Medicare program, providing essential medical coverage for eligible individuals. Understanding who needs it and how to enroll is vital for making informed healthcare decisions. By securing Part B, you can ensure access to important medical services and reduce your out-of-pocket healthcare expenses.