Who Has the Best Medicare Advantage Plan In 2024 | An Ultimate Guide

In a world where healthcare choices are abundant, selecting the best Medicare Advantage plan requires careful consideration and research. As we navigate the complex landscape of healthcare options, it’s crucial to understand the intricacies of Medicare Advantage plans and weigh the various factors that contribute to making an informed decision.

Contents

- 1 Understanding Who Has the Best Medicare Advantage Plan

- 2 Understanding Medicare Advantage Plans

- 3 Factors to Consider When Choosing a Medicare Advantage Plan

- 4 Comparison of Top Medicare Advantage Plans

- 5 Reviews and Ratings

- 6 Expert Recommendations

- 7 Popular Choices Among Seniors

- 8 Special Considerations

- 9 Tips for Enrolling in the Best Plan

- 10 Common Misconceptions About Medicare Advantage Plans

- 11 The Future of Medicare Advantage Plans

- 12 Frequently Asked Questions

- 13 Conclusion

Understanding Who Has the Best Medicare Advantage Plan

In navigating the healthcare landscape , understanding who offers the best Medicare Advantage plan becomes pivotal. Evaluating coverage options, premiums, and additional benefits is essential for informed decision-making. Plans tailored to individual needs, extensive networks, and enhanced perks can significantly impact the choice. Delving into reviews, expert recommendations, and popular choices among seniors provides valuable insights. As healthcare evolves, staying informed about special considerations and emerging trends ensures making the optimal choice for a Medicare Advantage plan.

Understanding Medicare Advantage Plans

Medicare Advantage plans, or Medicare Part C, offer an alternative to traditional Medicare by bundling coverage options. With benefits extending beyond basic Medicare, these plans often include vision, dental, and prescription drug coverage. Understanding the nuances of network restrictions, additional perks, and factors such as premiums and out-of-pocket costs is crucial in making an informed choice for comprehensive and tailored healthcare coverage.

Factors to Consider When Choosing a Medicare Advantage Plan

When embarking on the journey of selecting a Medicare Advantage plan, several key factors merit careful consideration to ensure the most suitable coverage for individual needs.

Coverage Options

The breadth of coverage provided by a Medicare Advantage plan is paramount. Variations exist in the levels of coverage for hospital stays, doctor visits, preventive services, and more. Evaluating these components is fundamental to addressing specific healthcare requirements.

Premiums and Out-of-Pocket Costs

While some plans boast low monthly premiums, it is crucial to scrutinize the overall cost implications. This includes assessing deductibles, copayments, and coinsurance. Achieving a balance between premiums and out-of-pocket expenses is pivotal for individuals mindful of their budget.

Network Restrictions

Understanding the network within which Medicare Advantage plans operate is essential. These plans often have specific networks of healthcare providers. Ensuring alignment with preferred professionals and facilities requires a thorough comprehension of network restrictions.

Additional Benefits

Beyond fundamental coverage, many Medicare Advantage plans entice enrollees with supplementary perks. These may include gym memberships, wellness programs, and telehealth services. The inclusion of these extra benefits can significantly influence the decision-making process, enhancing the overall value of the chosen plan.

In essence, a comprehensive evaluation of coverage options, cost considerations, network constraints, and additional benefits equips individuals to make well-informed decisions when selecting a Medicare Advantage plan. This diligence ensures not only financial prudence but also access to preferred healthcare services and an enriched overall healthcare experience.

Comparison of Top Medicare Advantage Plans

- Plan A: Comprehensive Coverage and Affordability: Plan A stands out for its comprehensive coverage, including low premiums and out-of-pocket costs. This plan is an excellent option for individuals seeking a balance between coverage and affordability.

- Plan B: Tailored Coverage with Competitive Premiums: For those with specific healthcare needs, Plan B offers tailored coverage options. With competitive premiums, it caters to individuals who prioritize personalized healthcare solutions.

- Plan C: Extensive Network and Additional Advantages: Plan C boasts an extensive network of healthcare providers, making it a suitable choice for individuals who value a wide range of options. The plan also offers additional advantages, such as wellness programs and preventive care.

- Plan D: Enhanced Benefits for Holistic Healthcare: Plan D goes beyond basic coverage by providing enhanced benefits for holistic healthcare. With additional perks like dental and vision coverage, it addresses the diverse needs of beneficiaries.

Reviews and Ratings

Before committing to a Medicare Advantage plan, it’s crucial to delve into reviews and ratings. Peer experiences and expert assessments offer valuable insights into the plan’s overall satisfaction and performance. Examining these reviews can provide a clearer understanding of how well the plan aligns with individual healthcare needs and expectations, aiding in the decision-making process.

Expert Recommendations

Seeking expert recommendations is a prudent step in choosing the right Medicare Advantage plan. Healthcare professionals possess valuable insights based on their expertise. Consulting with these experts ensures personalized advice aligned with individual health goals and preferences. By tapping into their knowledge, individuals can navigate the complex landscape of available plans and make informed decisions for optimal healthcare coverage.

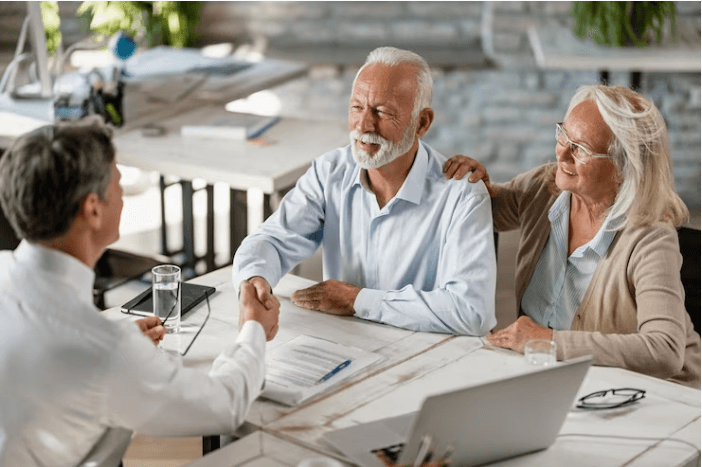

Popular Choices Among Seniors

Popular choices among seniors for Medicare Advantage plans often revolve around comprehensive coverage, affordable premiums, and additional perks. Plans with extensive networks and benefits catering to specific healthcare needs tend to be favored. Testimonials and success stories from older adults can provide valuable insights into the plans that have proven effective in enhancing their overall healthcare experience.

Special Considerations

In the realm of Medicare Advantage plans, staying informed about special considerations is paramount. Changes in coverage, benefits, and network options demand attention. Navigating the healthcare landscape with an awareness of updates for the specific year is crucial. Individuals must stay informed to make decisions aligned with their evolving healthcare needs and ensure the chosen plan remains tailored to their requirements.

Tips for Enrolling in the Best Plan

Navigating the enrollment process for the best Medicare Advantage plan requires strategic considerations. Understanding enrollment periods, deadlines, and necessary documentation is key. Individuals should gather information on plan options, assess their healthcare needs, and compare offerings diligently. Enrolling during the appropriate periods ensures a seamless transition to the chosen plan. This proactive approach empowers individuals to secure optimal coverage, aligning with their preferences and health requirements for a comprehensive and tailored healthcare experience.

Common Misconceptions About Medicare Advantage Plans

Debunking Myths and Misunderstandings

- Limited Provider Options: Contrary to belief, Medicare Advantage plans often have expansive networks, providing a wide array of healthcare professionals.

- Rigid Coverage: Addressing the misconception of inflexible coverage, these plans can be customized to suit individual healthcare needs, offering more flexibility than perceived.

Clearing Up Misconceptions

- Flexibility: Medicare Advantage plans provide flexibility, allowing individuals to tailor coverage to their specific health requirements.

- Coverage Options: Clarifying the diverse coverage options and additional benefits dispels misunderstandings, enabling informed decisions aligned with individual healthcare needs.

The Future of Medicare Advantage Plans

As the healthcare landscape evolves, anticipating the future of Medicare Advantage plans is crucial. Changes and improvements are expected, with emerging trends shaping the trajectory of these plans. Innovations in technology, services, and benefits are likely to enhance the overall healthcare experience for beneficiaries. Staying informed about these anticipated developments empowers individuals to make proactive choices, ensuring that their chosen Medicare Advantage plan remains aligned with evolving healthcare needs in the dynamic landscape of the future.

Frequently Asked Questions

Who Has the Best Medicare Advantage Plan ?

Determining the best Medicare Advantage plan is subjective and depends on individual healthcare needs. Evaluating coverage options, costs, and additional benefits offered by various plans, along with considering expert recommendations, ensures individuals find the most suitable plan for their specific requirements.

Which Medicare Advantage plan has the highest rating?

The Medicare Advantage plan with the highest rating can vary by region and year. It’s crucial to research and compare plans on the Medicare website, considering factors such as coverage, costs, and reviews, to determine the top-rated plan in a specific location for a given year.

What is the best insurance to go with Medicare?

Determining the best insurance to complement Medicare depends on individual needs. Many opt for supplemental Medigap plans to cover gaps in Medicare coverage, offering additional benefits and flexibility. Researching available options and considering personal health requirements helps in making an informed decision.

Is Medicare advantage better than Medigap?

Choosing between Medicare Advantage and Medigap depends on individual preferences and needs. Medicare Advantage offers bundled coverage, while Medigap provides supplemental insurance. Consider factors like cost, coverage, and preferred healthcare providers to determine which option aligns better with personal requirements.

Conclusion

Selecting the right Medicare Advantage plan involves a thorough assessment of individual needs, preferences, and plan offerings. Addressing misconceptions, staying informed about updates, and considering expert recommendations are pivotal. By navigating coverage options, evaluating costs, and understanding network constraints, individuals can make informed decisions for optimal healthcare. Choosing wisely ensures a tailored and comprehensive healthcare experience that aligns seamlessly with individual health goals and preferences.