Who Can Be on My Health Insurance In 2024 | An Ultimate Guide?

Health insurance is a vital aspect of life that ensures access to medical care and financial protection in case of illness or injury. Who Can Be on My Health Insurance? Understanding who can be covered by your health insurance plan is crucial, as it affects your family’s well-being and financial security.

Under certain circumstances, adult children may be eligible for coverage up to a certain age, even if they are no longer financially dependent. It’s essential to carefully review the terms and conditions of your specific health insurance plan to understand the eligibility criteria for coverage, ensuring that you comply with any enrollment deadlines and necessary documentation requirements.

Contents

Understanding Health Insurance

Health insurance is a vital component of modern healthcare, providing individuals with financial protection and access to medical services when they need them most. It is a complex system that can be challenging to navigate, but having a clear understanding of how health insurance works is crucial for making informed decisions about your healthcare.

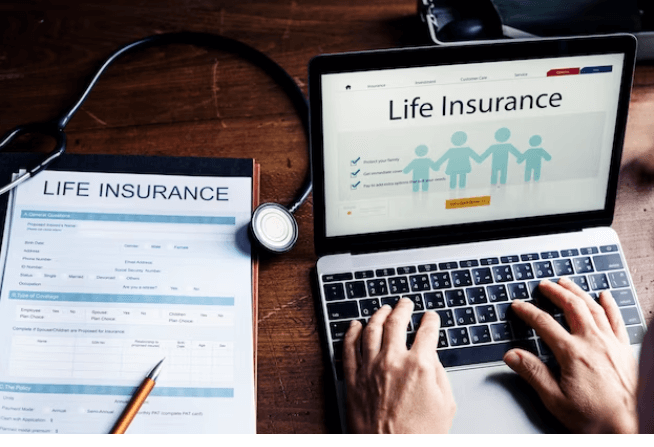

At its core, health insurance is a contract between you and an insurance company. You pay regular premiums, and in return, the insurer covers a portion of your medical expenses. This financial safety net can be a lifesaver when unexpected medical issues arise, as it helps to alleviate the often overwhelming burden of healthcare costs.

One key aspect of health insurance is the network of healthcare providers. Most insurance plans have a network of doctors, hospitals, and specialists that they work with. Staying within this network can significantly reduce your out-of-pocket costs. Going out of network may result in higher expenses or, in some cases, no coverage at all.

Deductibles, copayments, and coinsurance are other important terms to grasp. A deductible is the amount you must pay out of pocket before your insurance kicks in. Copayments are fixed fees you pay for specific services, while coinsurance is a percentage of the cost of a service that you are responsible for. Understanding these terms and how they apply to your plan can help you budget for medical expenses more effectively.

In addition, health insurance plans vary in terms of coverage. Some may focus on preventative care and wellness, while others may provide more comprehensive coverage, including prescription drugs and hospital stays. It’s crucial to choose a plan that aligns with your health needs and financial situation.

Types of Health Insurance Plans

Health insurance plans come in various types, each designed to cater to different healthcare needs and preferences. One common type is the Health Maintenance Organization (HMO) plan, which typically requires members to choose a primary care physician and obtain referrals for specialist visits. Preferred Provider Organization (PPO) plans offer more flexibility by allowing members to see both in-network and out-of-network providers, though the latter usually incur higher out-of-pocket costs.

Exclusive Provider Organization (EPO) plans to combine aspects of both HMO and PPO plans, limiting coverage to in-network providers except in emergencies. Point of Service (POS) plans blend HMO and PPO features, permitting out-of-network care but at a higher cost. High Deductible Health Plans (HDHPs) often accompany Health Savings Accounts (HSAs), enabling individuals to save pre-tax dollars for medical expenses.

Catastrophic health insurance is designed for young, healthy individuals and provides coverage for major medical expenses after a high deductible is met. Understanding the nuances of these plans is crucial for individuals and families to make informed decisions based on their healthcare needs and financial considerations.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a prevalent option provided by companies to their employees. This type of plan offers coverage as part of the employee benefits package, making it a convenient choice. It not only extends to the employee but often includes coverage for their family members, such as spouses and dependent children.

Individual and Family Health Insurance

Individual and family health insurance plans are purchased directly from insurance companies. These plans grant individuals and families the flexibility to choose the coverage that best suits their specific needs. They are particularly popular among those who are self-employed or do not have access to employer-sponsored coverage. Individual and family plans can be tailored to include additional family members, and the choice of coverage, deductibles, and premiums can vary widely to accommodate different budgets.

Government Health Insurance Programs

Government health insurance programs, such as Medicare and Medicaid, serve specific groups within the population. Medicare primarily caters to seniors aged 65 and older, providing them with essential healthcare coverage. Medicaid, on the other hand, extends coverage to low-income individuals and families, including children. These government programs have distinct eligibility criteria based on factors such as age, income, and other considerations.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a critical component of the American healthcare system, providing coverage to millions of workers and their families. This type of insurance is typically offered by employers as part of their employee benefits package, and it plays a vital role in ensuring access to healthcare services for a significant portion of the population.

One of the primary advantages of employer-sponsored health insurance is that it often allows employees to access healthcare services at a lower cost compared to purchasing individual insurance plans. Employers often negotiate with insurance providers to secure group rates, which can result in lower premiums for employees. Additionally, these plans typically offer a range of coverage options, allowing employees to select plans that best suit their healthcare needs, from basic coverage to more comprehensive plans.

Furthermore, employer-sponsored health insurance often provides a sense of financial security for employees and their families. Knowing that they have access to healthcare coverage can alleviate some of the stress associated with medical expenses, especially in times of unexpected illness or injury. This can contribute to improved job satisfaction and employee retention, as individuals are more likely to stay with employers who provide comprehensive benefits.

Employer-sponsored health insurance also contributes to the overall health and well-being of the workforce. Regular access to healthcare services encourages preventive care and early diagnosis, which can lead to better health outcomes and lower healthcare costs in the long run. Additionally, these plans often include wellness programs and resources aimed at promoting healthy lifestyles and disease prevention.

While employer-sponsored health insurance offers numerous benefits, it’s important to note that it can also be tied to employment status, making individuals dependent on their jobs for access to healthcare. This can create challenges for those who want to change jobs, work in non-traditional employment arrangements, or experience job loss. As the healthcare landscape continues to evolve, addressing the accessibility and affordability of health insurance outside the employer-sponsored model remains a critical concern.

Individual and Family Health Insurance

Individual and family health insurance plans are fundamental in securing the well-being of both individuals and their loved ones. These plans offer flexibility and choice, allowing policyholders to tailor their coverage to suit their unique needs. When it comes to individual health insurance, it’s a personal policy that typically covers a single person. It is an excellent choice for those who are self-employed or do not have access to employer-sponsored health insurance. These plans provide a safety net in times of illness or injury, ensuring that medical expenses are not a heavy burden.

On the other hand, family health insurance plans are designed to cover an entire household, including the policyholder, their spouse, and dependent children. They offer convenience by bundling multiple individuals into one comprehensive plan. This type of plan is ideal for families as it simplifies administrative tasks, such as managing premiums and tracking coverage. Moreover, family health insurance plans often come with cost savings when compared to ensuring each family member separately.

One significant advantage of these plans is the flexibility they offer in choosing healthcare providers. Policyholders can select doctors, specialists, and hospitals based on their preferences and health needs. This flexibility is essential in ensuring that you and your family receive the care you deserve. Additionally, many individual and family health insurance plans offer a wide range of services, from routine check-ups to emergency care, prescription drug coverage, and even preventive services.

The cost of these plans can vary based on factors such as the level of coverage, the number of family members included, and the deductible. It’s crucial to carefully review and compare different plans to find the one that aligns with your family’s health needs and budget. Individual and family health insurance ensures that medical expenses are not a barrier to accessing quality healthcare, offering peace of mind and security for you and your loved ones.

Government Health Insurance Programs

Government health insurance programs play a pivotal role in ensuring access to healthcare services for citizens in many countries around the world. These programs are designed to provide financial support and coverage for medical expenses, making healthcare more affordable and accessible to a broader population. In the United States, for example, the government administers several health insurance programs, including Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP), which collectively serve millions of Americans.

Medicare primarily serves the elderly and disabled, offering hospital insurance (Part A) and medical insurance (Part B), while Medicaid targets low-income individuals and families, providing a range of health services. CHIP is specifically aimed at children from low-income families, further emphasizing the government’s commitment to ensuring that vulnerable populations have access to essential healthcare services.

These programs not only assist in covering medical expenses but also promote preventive care and wellness initiatives, ultimately reducing the overall burden on the healthcare system. Government health insurance programs are financed through a combination of taxpayer contributions and federal funding, ensuring that the cost of healthcare doesn’t become a barrier to obtaining necessary medical treatment. The existence of these programs is a testament to the government’s role in safeguarding public health and ensuring that healthcare is a fundamental right accessible to all citizens, regardless of their socio-economic status. In doing so, they contribute to the overall well-being and longevity of the population, serving as a cornerstone of a more equitable healthcare system.

Who Can Be on Your Health Insurance?

When it comes to health insurance, understanding who can be covered under your policy is a pivotal aspect of ensuring the well-being of your loved ones and securing your financial health. Health insurance serves as a vital lifeline, providing access to essential medical care and offering financial protection in the face of unexpected illnesses or injuries. The first step in this journey is grasping the various types of health insurance plans available. These include employer-sponsored health insurance, individual and family health insurance, and government health insurance programs, each having its unique eligibility criteria and guidelines.

For many individuals, employer-sponsored health insurance is the go-to choice, as it’s often provided as part of their employment benefits. In this scenario, the policyholder is typically the employee, and they have the option to add their family members to the plan. This is a convenient option, but it’s essential to recognize that eligibility might differ based on the employer’s policies and rules. On the other hand, individual and family health insurance plans, acquired directly from insurance companies, offer flexibility in selecting a plan that caters to specific needs and budget constraints. However, eligibility here is subject to the rules of the chosen insurance provider.

Government health insurance programs, such as Medicare and Medicaid, are designed to assist specific demographic groups, such as seniors, low-income individuals, and children. Eligibility for these programs is determined by a range of factors, including age, income, and more. The fundamental question remains: who can be added to your health insurance plan to ensure their coverage? This typically includes your spouse and dependent children, providing a common and straightforward approach to safeguarding your family’s healthcare needs. Additionally, your biological or legally adopted children are generally eligible, and in many cases, stepchildren can be included if they are financially dependent on the policyholder.

Furthermore, some insurance plans may allow the inclusion of domestic partners, recognizing committed, non-marital relationships. Additionally, in specific circumstances, adult children may remain on their parent’s health insurance plan until a particular age, even if they are no longer financially dependent. However, it’s crucial to emphasise that eligibility criteria for health insurance coverage can vary significantly. Therefore, it’s advisable to consult with your insurance provider to gain clarity on who can be included in your plan, as different plans may have differing rules and regulations in place. Regularly reviewing your policy and making necessary updates is also essential to ensure that it continues to meet your family’s healthcare requirements. In summary, knowing who can be on your health insurance is pivotal to making the most of your coverage, and safeguarding your family’s health and financial security.

Importance of Regular Updates

In today’s fast-paced digital world, the importance of regular updates cannot be overstated. Whether it pertains to software, technology, news, or even personal growth, staying up-to-date is crucial for a multitude of reasons. First and foremost, regular updates are essential for the security of our digital devices and systems. Software developers constantly release updates to patch vulnerabilities and protect against evolving threats. Failing to install these updates can leave your devices and personal information vulnerable to cyberattacks.

Moreover, regular updates are vital for the improvement of functionality and performance. Software and apps often come with bug fixes and feature enhancements that enhance user experience. Neglecting these updates may result in reduced efficiency and frustration as you miss out on new and improved features. Additionally, updates can help maintain compatibility with other software and hardware, ensuring your devices work seamlessly together. Without regular updates, you may encounter compatibility issues that hinder your productivity and overall user experience.

Beyond technology, staying updated with current events and news is crucial in today’s information-driven world. Regularly consuming news updates allows individuals to stay informed about global events, changes in policies, and developments in various fields. This knowledge is vital for making informed decisions in both personal and professional life.

In the realm of personal growth, the importance of regular updates is also evident. Learning and adapting to new knowledge and skills is essential for personal and professional development. Stagnation can hinder progress and limit opportunities while staying current with industry trends and developments opens doors to new possibilities. Continuous learning through books, courses, and exposure to new ideas can lead to personal growth and career advancement.

FAQs

Can you add anyone to health insurance?

Yes, you can typically add dependents, such as spouses, children, and sometimes domestic partners, to your health insurance policy during the enrollment period or due to a qualifying life event.

Can my girlfriend be on my health insurance?

In most cases, girlfriends are not eligible for coverage on your health insurance unless you are legally married or in a domestic partnership. Check with your insurance provider for specific eligibility criteria.

Who can you list as your health-covered beneficiary?

You can typically list your spouse and dependent children as beneficiaries on your health insurance policy. Some policies may also allow you to designate domestic partners or other dependents. Be sure to check your policy for specific beneficiary options.

Can I be on my own health insurance and my husband’s?

Generally, you cannot be covered under both your own health insurance and your husband’s simultaneously. You’ll need to choose one policy as your primary coverage. Coordination of benefits may apply when both spouses have coverage to determine which policy pays first.

Should my wife and I be on the same health insurance?

Whether you and your wife should be on the same health insurance policy depends on your individual circumstances and the available options. It’s common for spouses to be on the same policy, but it’s essential to compare plans and consider factors like cost and coverage to make the best decision for your family.

Conclusion

Health insurance is a critical aspect of our lives, ensuring that we have access to medical care when we need it and protecting us from substantial financial burdens in times of illness or injury. Understanding who can be included in your health insurance plan is essential for providing for your family’s healthcare needs and ensuring their well-being. Whether it’s your spouse, children, stepchildren, domestic partners, or even adult children, there are various criteria to consider, and these can vary between different insurance providers and plans. Keeping your policy updated to reflect changes in your life circumstances is crucial to ensure that your loved ones receive the necessary coverage.