Which Dog Insurance Should I Get in 2024? | Comprehensive Guide?

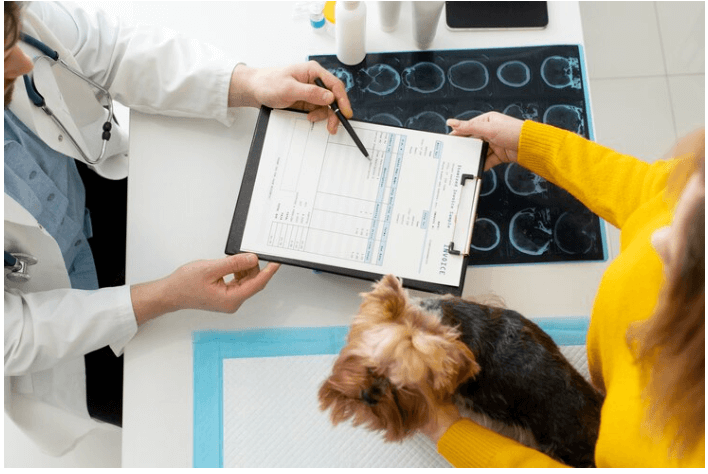

As a responsible dog owner, ensuring the well-being of your furry companion is a top priority. One essential aspect of pet care that often gets overlooked is acquiring the right insurance for your dog. “Which Dog Insurance Should I Get?” In this article, we’ll delve into the complexities of dog insurance, debunk common myths, explore different types, and guide you in choosing the most suitable coverage for your canine friend.

Choosing dog insurance depends on your pet’s needs, your budget, and coverage preferences. Consider reputable providers like Healthy Paws, Embrace, or Petplan. Compare policies, coverage limits, deductibles, and customer reviews. Look for comprehensive coverage that includes illness, accidents, and preventive care. Tailor the plan to your dog’s breed, age, and health history for the best fit.

Contents

Importance of Dog Insurance

Dog insurance is crucial for the well-being of both pets and their owners. Just like humans, dogs can face unexpected health issues, accidents, and emergencies that may lead to substantial veterinary bills. Dog insurance provides financial protection, ensuring that pets.

Routine check-ups, vaccinations, and preventive measures are essential for a dog’s overall health. Dog insurance encourages responsible pet ownership by covering these routine expenses, and promoting regular veterinary visits that can detect and address potential health issues early on.

In the face of accidents or sudden illnesses, dog insurance acts as a safety net, preventing owners from having to make difficult decisions based on financial constraints. It ensures that pets receive prompt and comprehensive medical attention, increasing the likelihood of successful treatment outcomes. Owners can afford necessary medical care without compromising.

Moreover, the emotional bond between humans and dogs is profound, and knowing that one’s pet is insured provides peace of mind. It allows pet owners to focus on their dog’s well-being rather than worrying about the financial burden of unexpected veterinary expenses. In summary, dog insurance is an investment in the health, happiness, and longevity of canine companions, fostering a relationship of care and responsibility between pets and their owners.

Types of Dog Insurance

There are various types of dog insurance, including accident-only coverage, illness coverage, wellness plans for routine care, and comprehensive plans that combine both. Some policies also offer coverage for hereditary conditions, alternative therapies, and behavioral issues.

Health Insurance

When considering dog insurance, health coverage is often at the forefront. It encompasses a range of medical expenses, from routine check-ups to unexpected emergencies. Understanding the coverage details and recognizing the benefits of health insurance can be crucial in making an informed decision.

Liability Insurance

While health insurance focuses on your dog’s well-being, liability insurance addresses potential legal and financial implications. We’ll explore scenarios where liability coverage becomes imperative and help you understand its significance in the broader context of dog ownership.

Wellness Plans

Some insurance providers offer wellness plans that go beyond health coverage. These plans typically include preventive care measures, such as vaccinations and regular screenings. We’ll discuss the pros and cons of opting for a wellness plan and how it complements other forms of dog insurance.

Cost of Dog Insurance

The cost of dog insurance varies based on several factors, including the dog’s breed, age, size, pre-existing conditions, and the chosen coverage. On average, monthly premiums can range from $25 to $70, but this figure can increase for comprehensive plans or specific breeds prone to health issues.

Puppies generally have lower premiums than older dogs, and certain breeds may have higher costs due to breed-specific health concerns.

Additional factors influencing costs include the chosen deductible, reimbursement percentage, and annual payout limits. A higher deductible or lower reimbursement percentage may result in lower premiums but might mean higher out-of-pocket expenses during claims. Pre-existing conditions often lead to higher premiums or may be excluded from coverage.

Wellness plans covering routine care, vaccinations, and preventive measures also impact costs. Some insurers offer customizable plans, allowing owners to tailor coverage based on their budget and pet’s needs.

To find the most cost-effective option, it’s crucial to compare quotes from different insurers, considering both the monthly premium and the overall value of the coverage provided. Regularly reviewing and adjusting coverage as your dog ages or if their health status changes ensures that you are getting the most suitable and cost-efficient insurance for your furry companion.

How to buy pet insurance?

To purchase pet insurance, begin by researching reputable providers and comparing their offerings. Assess your pet’s breed, age, and health history to determine the most suitable coverage. Request quotes from multiple insurers, considering factors such as premiums, deductibles, and customer reviews. Evaluate policy details, paying attention to coverage limits, waiting periods, and exclusions.

Seek clarification on any uncertainties by contacting the insurance provider directly. Once satisfied, enroll your pet online or over the phone, providing accurate information about your furry companion. Complete the payment process to activate coverage, and consider opting for a payment plan if available. Regularly review the policy to ensure it aligns with your pet’s evolving needs. Purchasing pet insurance is a proactive step toward safeguarding your pet’s health and managing unexpected veterinary expenses, promoting peace of mind for responsible pet ownership.

How to Choose the Right Insurance for Your Dog?

Armed with information on different types of insurance and factors to consider, we’ll guide you through the process of selecting the most appropriate coverage for your dog. This section will help you assess your dog’s specific needs, navigate policy details, and seek recommendations from veterinarians and other dog owners.

Choosing the right insurance for your dog involves considering your pet’s specific needs, your budget, and the coverage offered. First, assess your dog’s breed, age, and health history to determine potential risks. Evaluate your financial capacity and choose a plan that balances coverage and affordability.

Examine policy details, including coverage for accidents, illnesses, preventive care, and hereditary conditions. Look for plans that offer flexibility in choosing veterinarians and provide coverage for prescription medications. Consider the waiting periods for coverage to take effect and any exclusions or limitations. Aligns with your dog’s health needs and your financial constraints.

Read customer reviews to gauge the insurer’s reputation for claims processing and customer service. Additionally, inquire about reimbursement methods, deductible options, and annual payout limits. It’s advisable to compare quotes from multiple providers to find the most suitable and cost-effective insurance.

How can you save money on dog insurance?

To save money on dog insurance, consider the following strategies. First, compare quotes from different insurers to find the most cost-effective coverage for your pet’s needs. Opt for a higher deductible, as this can lower monthly premiums. Choose a plan that focuses on essential coverage rather than extensive add-ons. Enroll your dog while they are still young and healthy to secure lower premiums.

Maintain your pet’s overall health through regular exercise and a balanced diet to reduce the likelihood of claims. Some insurers offer discounts for enrolling multiple pets or for military personnel, veterans, or members of certain organizations. Lastly, consider paying annually instead of monthly, as some insurers provide discounts for annual payments. By being proactive in your approach and exploring various cost-saving options, you can ensure your pet is covered without breaking the bank.

FAQs about Which Dog Insurance Should I Get

What kind of dog insurance should I get?

The best type of dog insurance is lifetime cover because these types of policies have limits that renew each year. Renewing limits protect against long-term or recurring conditions throughout your dog’s life. The next best type of cover is usually considered to be max benefit.

Is it worth taking out dog insurance?

Pet insurance can cover the costs of treating your pet if they suffer from an illness or are injured in an accident and need treatment from a vet. It could save you from an unexpected and potentially very high bill. Depending on what type of cover you have, pet insurance

What are the 4 types of pet insurance?

There are four main types of pet insurance – Lifetime, Annual (or time-limited), Accident only, and Maximum benefit.

How much cover should I get for my dog UK?

As a general rule, covering less than £5000 is likely to leave you with problems if your dog gets in a serious accident, and £7000 is the minimum most vets would consider to be fairly comprehensive.

Do vets charge more if you have pet insurance?

If your pet is insured, it is always a good idea to look at your policy and even contact your insurer to verify that the veterinary costs are covered by the policy.

Conclusion

Choosing the right dog insurance involves careful consideration of your dog’s unique needs and your budget constraints. By understanding the different types of insurance, evaluating critical factors, and researching popular providers, you can ensure that your canine companion receives the best possible care.