Which Dog Insurance Is Best In 2024? | A Comprehensive Guide

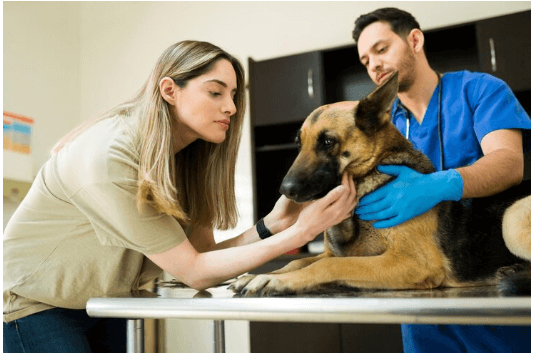

Pet ownership brings joy and companionship, but it also comes with responsibilities, including ensuring the health and well-being of your furry friend. Dog insurance is a valuable tool in managing veterinary costs and providing optimal care for your pet. “Which Dog Insurance Is Best?” With various options available, choosing the best dog insurance requires careful consideration of factors such as coverage, costs, and customer satisfaction.

Best dog insurance depends on individual factors such as the dog’s breed, age, health needs, and the owner’s budget. Popular options like Healthy Paws, Trupanion, Nationwide, and Petplan offer various coverage plans. Consider the comprehensiveness of coverage, reimbursement rates, deductibles, and customer reviews. No single insurance is universally “best,” as it should align with the unique requirements of both the pet and owner. Thoroughly research and compare policies to find the most suitable coverage for your dog’s well-being and your financial preferences.

Contents

Understanding Dog Insurance

Dog insurance provides financial protection for veterinary expenses, ensuring that pet owners can afford necessary medical care for their canine companions. Policies typically cover illness, injury, and preventive care, including vaccinations and annual check-ups. When considering dog insurance, factors such as coverage limits, deductibles, and reimbursement rates must be weighed. Comprehensive plans may include hereditary conditions and behavioral treatments.

Different types of coverage exist, including accident-only, illness-only, and comprehensive plans. It’s essential to assess the individual needs of the dog, considering factors like breed predispositions and potential health risks. Additionally, some policies may offer wellness plans for routine care.

The cost of dog insurance varies based on factors like the dog’s age, breed, and the chosen coverage. Researching reputable providers, reading policy details, and comparing quotes can help find a plan that suits both the pet’s health requirements and the owner’s budget.

Having dog insurance can alleviate financial stress during unexpected health issues, enabling pet owners to provide optimal care. Regularly reviewing and updating coverage ensures that it remains aligned with the dog’s evolving health needs throughout its life.

Importance of Dog Insurance

Dog insurance serves as a financial safety net, covering unexpected veterinary expenses such as accidents, illnesses, and surgeries. It allows pet owners to make decisions based on the best interest of their pet’s health rather than financial constraints.

Dog insurance is crucial for pet owners to safeguard their furry companions’ health while managing unexpected veterinary expenses. It provides financial support for necessary medical treatments, surgeries, and medications, enabling prompt and comprehensive care. In emergencies or if the dog develops a chronic condition, insurance ensures that the best available treatments.

Routine veterinary care, preventive measures, and vaccinations are often covered, promoting overall well-being. The emotional bond between pets and owners is strengthened when financial concerns are alleviated, allowing for informed healthcare decisions. Dog insurance not only protects against unforeseen health issues but also encourages responsible pet ownership, as routine check-ups and preventive care contribute to a longer, healthier life for the canine companion. Ultimately, investing in dog insurance offers peace of mind, allowing pet owners to focus on their dogs’ health and happiness without financial constraints.

Types of Dog Insurance Coverage

Dog insurance typically offers coverage for accidents, illnesses, and preventive care. Accidents coverage includes injuries resulting from unforeseen events, while illness coverage addresses chronic conditions and diseases. Preventive care may cover routine check-ups, vaccinations, and dental care.

Dog insurance coverage comes in various types to address different aspects of a pet’s health:

- Accident-Only Coverage: Focuses on injuries resulting from accidents, such as fractures or injuries sustained in a car accident.

- Illness Coverage: Covers veterinary expenses for a wide range of illnesses, including infections, cancer, and chronic conditions.

- Comprehensive Coverage: Combines both accident and illness coverage, offering broad protection for various medical needs.

- Wellness Plans: Address routine care, including vaccinations, dental cleanings, and preventive measures to maintain the dog’s overall health.

- Hereditary and Congenital Conditions Coverage: Includes conditions that may be genetically predisposed or present at birth.

- Behavioral Treatment Coverage: Some policies cover expenses related to behavioral issues, such as training or therapy.

Pet owners can tailor coverage based on their dog’s breed, age, and specific health considerations, ensuring a customized approach to veterinary care that aligns with their pet’s individual needs.

Comparing Dog Insurance Providers

When comparing dog insurance providers, consider factors such as coverage options, deductibles, premiums, and reimbursement rates. Evaluate customer reviews and ratings for insight into customer satisfaction. Examine each provider’s network of veterinarians and any coverage limitations or exclusions. Be attentive to waiting periods for coverage and any age restrictions. Look for additional benefits, such as wellness plans or coverage for hereditary conditions. Ultimately, selecting a reputable provider that aligns with your dog’s specific health needs and your budget ensures comprehensive and reliable coverage.

Nationwide Pet Insurance

Nationwide is a well-known provider offering comprehensive coverage for dogs. Their plans include accident and illness coverage, as well as optional add-ons for preventive care. Nationwide is praised for its broad network of veterinarians. Nationwide Pet Insurance offers comprehensive coverage for pets, including illness, accidents, and preventive care, with customizable plans to suit individual needs.

Healthy Paws Pet Insurance

Healthy Paws is recognized for its straightforward approach and high customer satisfaction. They offer unlimited lifetime benefits for accidents and illnesses, and their claims process is known for being efficient. Healthy Paws Pet Insurance provides comprehensive coverage for pets, offering protection against accidents, and illnesses, and includes unlimited lifetime benefits.

Trupanion Pet Insurance

Trupanion provides lifetime coverage for illnesses and accidents, with no payout limits. They are known for their commitment to covering the actual cost of veterinary care, offering peace of mind to pet owners facing unexpected expenses. Trupanion Pet Insurance provides comprehensive coverage for pets, covering illnesses and injuries with no payout limits, and offering financial security for pet owners.

Petplan Pet Insurance

Petplan offers customizable policies with various coverage options. Their policies cover accidents, illnesses, and hereditary conditions. Petplan is praised for its flexibility and responsive customer service. Petplan Pet Insurance provides coverage for veterinary expenses, including accidents, illnesses, and hereditary conditions, offering customizable plans for pet owners.

Choosing the Best Dog Insurance

Some insurance providers may offer coverage for pre-existing conditions, while others do not. If your dog has pre-existing health concerns, carefully review each policy’s stance on coverage for such conditions. Most dog insurance providers do not cover pre-existing conditions.

Choosing the best dog insurance involves evaluating coverage options, considering deductibles and premiums, and ensuring compatibility with the pet’s specific needs. Read customer reviews to gauge satisfaction and check for limitations. Verify the provider’s network of veterinarians and assess waiting periods. Look for additional benefits like coverage for hereditary conditions.

Compare plans from reputable providers such as Healthy Paws, Trupanion, Nationwide, and Petplan to find a policy that offers the right balance of coverage and affordability for your furry companion. It’s essential to review policy details to understand exclusions and limitations, ensuring clarity on coverage for any existing health issues.

Cost Factors

While cost is a significant consideration, it’s essential to balance it with coverage. Cheaper policies may have higher deductibles or limited coverage. Evaluate the overall value based on your pet’s needs and your budget. Dog insurance costs are influenced by factors like the dog’s age, breed, location, chosen coverage, deductible amount, and the provider’s pricing structure, affecting overall affordability for pet owners.

Customer Reviews and Satisfaction

Researching customer reviews provides valuable insights into the experiences of other pet owners. Look for feedback on the claims process, customer service, and overall satisfaction with the insurance provider. Customer reviews and satisfaction are crucial when choosing dog insurance. Evaluating feedback from other pet owners provides insights into the quality of service, claims processing, and overall customer experience.

Frequently Ask Questions

What type of dog insurance is best?

The best type of dog insurance is lifetime cover because these types of policies have limits that renew each year. Renewing limits protect against long-term or recurring conditions throughout your dog’s life. The next best type of cover is usually considered to be max benefit.

What is the best age to get dog insurance?

The best age to get pet insurance for dogs is when they’re young (puppies are best). As they age their health will inevitably decline, and they’ll be inherently riskier to insure. That risk will be passed on to you, the owner, in the form of higher monthly and annual insurance premiums.

Which dog insurance is best?

Determining the best dog insurance depends on individual preferences, budget, and the specific needs of the pet. Popular options include companies like Healthy Paws, Trupanion, and Embrace, each offering different coverage options, deductibles, and premiums. Researching and comparing plans ensures the right fit for your pet’s health and financial considerations.

What is the best pet insurance at a reasonable price?

Lemonade is the cheapest pet insurance company for dogs, charging an average of $30.10 monthly. ManyPets is the most affordable pet insurance provider for cats, with an average monthly cost of $15.92. Read on to learn more about Lemonade, ManyPets, and our other top three cheapest pet insurance options.

What to look for when buying pet insurance?

The type of policy; age of your pet; your pet’s health; claims or treatment history; where you live; purchase price; the breed of your pet; and if it is male or female. Claims costs and the amount vets charge for treatment can also impact premiums.

Conclusion

Choosing the best dog insurance requires a thoughtful examination of your pet’s needs, your budget, and the offerings of different insurance providers. Evaluate coverage options, consider customer satisfaction, and weigh the cost against the benefits. By making an informed decision, you can provide your furry companion with the healthcare protection they deserve.