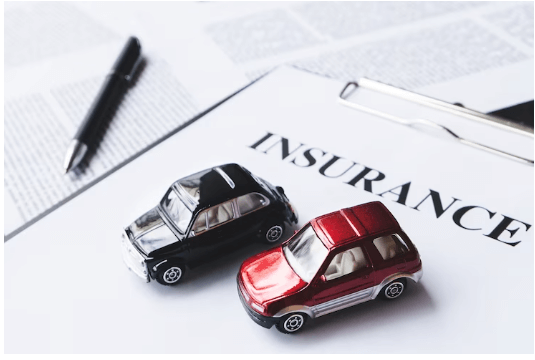

Where to Compare Auto Insurance Rates In 2024

Auto insurance is a vital component of responsible vehicle ownership. However, it’s no secret that insurance rates can vary significantly from one provider to another. In this article, we’ll explore the factors that influence auto insurance rates and provide insights into where and how you can compare these rates effectively. Where to Compare Auto Insurance Rates.

Contents

Understanding Auto Insurance Rates

Understanding auto insurance rates is crucial for every vehicle owner, as the cost of coverage can vary significantly based on various factors. One of the primary determinants is the driver’s personal history, including their driving record, age, and gender. A clean driving record with no accidents or traffic violations often results in lower premiums, while younger and less experienced drivers may face higher costs.

Another significant factor influencing auto insurance rates is the coverage options selected by the policyholder. Comprehensive coverage, which protects against non-collision events like theft or natural disasters, tends to raise premiums. On the other hand, opting for higher deductibles or choosing only the essential coverage can help lower costs. The geographical location of the insured driver.

Discounts and incentives can offset high insurance rates, and many companies offer discounts for safe driving courses, multi-car policies, or bundling auto insurance with other types of coverage. Loyalty to an insurance provider may also result in discounted rates over time. It’s essential for consumers to regularly review their policies and shop around for competitive rates, as the insurance market is dynamic, and different companies may offer varying discounts and pricing structures.

Factors That Impact Auto Insurance Rates

Auto insurance rates are influenced by a myriad of factors that collectively determine the level of risk a policyholder poses to the insurance provider. One of the primary considerations is the driver’s personal information, including age, gender, and marital status. Younger drivers and males tend to face higher premiums due to statistically higher accident rates. Additionally, marital status can play a role, as married individuals are often perceived as more responsible and may benefit from lower rates.

The type of vehicle being insured also significantly impacts insurance rates. Factors such as the make and model, safety features, and the car’s age contribute to the overall risk assessment. Sports cars or high-performance vehicles generally incur higher premiums due to their increased likelihood of being involved in accidents. Safety features, on the other hand, can have a positive influence on rates.

Credit history is increasingly being considered by insurance providers as a predictive tool for assessing risk. Individuals with a higher credit score are often deemed more financially responsible and may be eligible for lower premiums. Insurance companies also consider the policyholder’s coverage history and the chosen coverage limits and deductibles.

Where to Compare Auto Insurance Rates

When it comes to finding the best auto insurance rates, consumers are faced with a plethora of options and information. One effective way to navigate through this complexity is by utilizing online platforms dedicated to comparing auto insurance rates. These platforms, often referred to as insurance comparison websites, allow users to input their specific details and preferences, such as driving history, vehicle make and model, and coverage needs.

One popular destination for such comparisons is websites like “Insurance.com” and “Compare.com,” where users can easily obtain quotes from multiple insurance providers with just a few clicks. This streamlined process empowers individuals to make informed decisions about their coverage by presenting a side-by-side analysis of various policies, highlighting the differences in premiums, deductibles, and coverage limits.

Moreover, many state insurance departments offer online tools to help consumers compare auto insurance rates specific to their region. These government-sponsored platforms provide a reliable source for understanding the average rates and regulations that may impact insurance premiums in a particular area. By leveraging these resources, consumers can gain valuable insights into the competitive landscape of the insurance market and make choices aligned with both their financial constraints and coverage requirements.

Another avenue for comparing auto insurance rates is through independent insurance brokers. These professionals have access to a wide array of insurance providers and can offer personalized assistance in finding the most suitable coverage at the best possible rates. Unlike comparison websites, brokers can provide expert advice and tailor recommendations based on individual needs, ensuring that clients receive a comprehensive understanding of their options.

How to Effectively Compare Rates

When it comes to comparing rates, whether for loans, insurance, or other financial products, a strategic approach is crucial to making informed decisions. Firstly, identify your specific needs and preferences. Different financial products cater to diverse requirements, and understanding your own priorities will help narrow down the options. Once you have a clear idea of what you’re looking for, start researching various providers. Look beyond the advertised rates; consider fees, terms, and any hidden costs that might impact the overall cost of the product.

Secondly, leverage technology and online resources. Numerous websites and platforms allow you to compare rates from different providers side by side. Utilize these tools to streamline your research process and gain a comprehensive view of the market. Additionally, don’t hesitate to explore customer reviews and testimonials. Predicting future economic conditions can be challenging.

Thirdly, be aware of the fine print. Terms and conditions can vary significantly between providers, and what seems like a low rate at first glance may come with restrictive terms that make the overall package less favorable. Take the time to read through the details and, if needed, seek clarification from the provider. This diligence ensures that you’re not caught off guard by unexpected conditions that could impact your financial well-being.

Benefits of Comparing Auto Insurance Rates

Comparing auto insurance rates offers a myriad of benefits that extend beyond mere cost savings. Firstly, one of the most apparent advantages is the potential for substantial financial savings. Different insurance providers often offer varying rates for similar coverage, and by diligently comparing these options, individuals can identify policies that align with their budgetary constraints. This not only ensures that drivers secure the most competitive rates available but also facilitates the optimization of their insurance coverage to suit their specific needs.

This informed decision-making process empowers individuals to select policies that not only meet legal requirements but also provide comprehensive protection tailored to their unique circumstances. In essence, comparing rates acts as an educational tool, fostering a deeper understanding of the intricacies of insurance policies. ultimately raising the overall standard of auto insurance.

Additionally, the competitive nature of the insurance market incentivizes companies to continually enhance their offerings to attract customers. As a result, consumers benefit from a broader array of choices and more attractive policy features. This fosters a healthy market dynamic where insurers strive to provide better services and value.

Common Misconceptions

Misconceptions, often rooted in misinformation or partial understanding, can shape perceptions and influence decision-making. One prevalent fallacy is the idea that vaccines cause autism. Despite numerous scientific studies debunking this claim, the myth persists, contributing to vaccine hesitancy and undermining public health efforts. Another widespread misconception is the notion that all mental health conditions result from personal weakness.

Additionally, the belief that multitasking enhances productivity is a misconception that many fall prey to in today’s fast-paced world. Research indicates that multitasking can lead to decreased efficiency and increased errors, as the brain struggles to switch between tasks. Understanding the importance of focused attention and single-tasking is essential for improving overall productivity and quality of work.

In the realm of technology, a prevalent misconception is that private browsing modes make users completely anonymous online. While these modes may enhance privacy by limiting data retention, they do not provide absolute anonymity. Users should be aware of the limitations and take additional steps to protect their online privacy. Dispelling these and other misconceptions requires a concerted effort to promote accurate information, critical thinking, and open dialogue. Addressing and correcting these misunderstandings can lead to a more informed and enlightened society.

FAQs about Where to Compare Auto Insurance Rates

What is the best app for comparing car insurance rates?

The best apps for comparing car insurance rates can vary, but popular options include “The Zebra,” “Insurance.com,” and “Compare.com.” These apps allow you to quickly and conveniently compare quotes from multiple insurers.

Who has the cheapest auto insurance rates?

The company offering the cheapest auto insurance rates can vary by individual circumstances. Geico, Progressive, and USAA are often recognized for competitive rates, but the best choice depends on factors like your location, driving history, and coverage needs.

Who has the highest auto insurance rates?

The insurer with the highest auto insurance rates can vary based on similar factors, but companies like Allstate, Farmers, and Nationwide are sometimes associated with higher premiums. The actual rates depend on specific details in your policy and profile.

What is the best auto insurance setting?

The best auto insurance setting depends on your unique needs. To determine this, consider factors such as your vehicle, location, driving habits, and budget. Working with an insurance agent can help you select the right coverage settings tailored to your situation.

What are three things we should consider when choosing auto insurance?

When choosing auto insurance, consider three crucial factors: coverage type and limits (e.g., liability, comprehensive, collision), cost (premiums and deductibles), and the reputation and customer service of the insurer. Evaluating these elements ensures you have the right coverage at an affordable price, backed by a reliable company.

Conclusion

Comparing auto insurance rates is a fundamental step in securing the best coverage at the most affordable price. By understanding the factors influencing rates and utilizing the available comparison tools, you can make an informed decision that suits your specific needs and budget. Remember that the insurance landscape is dynamic, and your circumstances may change, so periodic rate comparisons are essential to ensure you consistently receive the most value from your auto insurance policy.