Where Do I Buy Life Insurance In 2024 | An Ultimate Guide

To buy life insurance, you have several options. You can approach traditional insurance companies, consult independent insurance agents, or utilize online platforms. Reputable insurance providers offer a range of policies, and online platforms facilitate easy comparison of quotes and features. Research different sources, consider customer reviews, and assess policy details to make an informed decision. Whether through a trusted agent, a well-known company, or the convenience of online channels, the key is to find a reliable provider that aligns with your specific needs and financial objectives.

Contents

- 1 Understanding Where Do I Buy Life Insurance?

- 2 Understanding Your Needs

- 3 Types of Life Insurance Policies

- 4 Choosing the Right Policy

- 5 Researching Insurance Providers

- 6 Online Platforms for Life Insurance

- 7 Common Misconceptions about Life Insurance

- 8 Factors Affecting Premiums

- 9 Applying for Life Insurance

- 10 Waiting Period and Coverage Activation

- 11 Perplexity in Life Insurance Decisions

- 12 Burstiness in Financial Planning

- 13 Frequently Asked Question

- 14 Conclusion

Understanding Where Do I Buy Life Insurance?

In the realm of securing your financial future, the question of “Where do I buy life insurance?” is a pivotal one. Life insurance serves as a safety net, providing financial protection for your loved ones in the event of your passing. To embark on this journey, start by understanding your specific needs. Assess your financial situation, including income, expenses, and outstanding debts. This introspection will guide you in determining the appropriate coverage required to safeguard your family’s well-being.

Life insurance comes in various forms, such as term life insurance, whole life insurance, and universal life insurance. Each type caters to different needs and preferences. As you navigate this diverse landscape, factor in considerations like your age, health condition, and financial goals. Seeking guidance from a financial advisor can further refine your decision-making process.

Researching insurance providers is a crucial step in finding the right coverage. Compare quotes from different companies and delve into customer reviews and ratings to gauge reliability. The digital age has ushered in the convenience of buying life insurance online. Explore the advantages of online platforms, appreciating the streamlined application process and accessibility.

Dispelling common misconceptions about life insurance adds clarity to your decision-making. Learn about the factors influencing premiums, the application process, and nuances like waiting periods before coverage activates. By embracing this knowledge, you empower yourself to make informed choices, navigating the perplexity of life insurance decisions with confidence. Ultimately, purchasing life insurance is an investment in your family’s financial security, and understanding where to buy it ensures a step in the right direction.

Understanding Your Needs

Understanding your needs is a pivotal first step when contemplating the purchase of life insurance. It involves a comprehensive evaluation of your financial landscape, aiming to align the coverage with your unique circumstances. Start by scrutinizing your income, expenses, and outstanding debts. This introspective process provides a foundation for determining the ideal amount of coverage necessary to secure your family’s financial future in the event of unforeseen circumstances.

The assessment should extend beyond the basics, delving into considerations like lifestyle, future financial goals, and dependents. Take into account ongoing financial responsibilities, such as mortgages, educational expenses, and day-to-day living costs. By comprehensively understanding your needs, you can tailor your life insurance coverage to address specific financial commitments and ensure your loved ones are adequately protected.

Additionally, factor in long-term considerations, such as the potential for your family’s financial needs to evolve over time. A well-thought-out life insurance policy should be flexible enough to adapt to changing circumstances. This forward-thinking approach enables you to make informed decisions that anticipate future requirements, reinforcing the stability and security provided by your life insurance coverage.

Seeking guidance from a financial advisor during this process can provide valuable insights. A professional can help navigate the complexities of assessing needs, offering expertise in aligning coverage with individual circumstances. In essence, understanding your needs is not just a prerequisite; it is a strategic approach to crafting a life insurance plan that serves as a robust safeguard for the financial well-being of your loved ones.

Types of Life Insurance Policies

Navigating the world of life insurance involves understanding the various types of policies available, each designed to meet different needs and preferences. One prominent category is term life insurance, which provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a straightforward approach, paying out a death benefit if the policyholder passes away during the specified term.

Whole life insurance, on the other hand, is a lifelong coverage option. It not only provides a death benefit but also accumulates cash value over time. This cash value can be accessed or borrowed against during the policyholder’s lifetime, adding an investment component to the insurance.

Universal life insurance combines insurance with flexibility. It allows policyholders to adjust the premium payments and death benefits, providing versatility to adapt to changing financial circumstances. This type of policy also accrues cash value, which can be invested, offering potential growth.

Choosing the right life insurance policy involves considering factors such as age, health, financial goals, and preferences. Term life insurance may be suitable for those seeking temporary coverage for specific financial obligations, while whole life insurance might appeal to those looking for lifelong protection and an investment component. Universal life insurance, with its adjustable features, suits individuals seeking flexibility in their coverage.

Consulting with a financial advisor is crucial when determining the most suitable policy. Their expertise can guide individuals in aligning their unique circumstances with the features of each type of life insurance, ensuring a well-informed decision that meets both short-term and long-term needs.

Choosing the Right Policy

Choosing the right life insurance policy is a crucial decision that hinges on various factors, each requiring thoughtful consideration. One primary factor to weigh is the individual’s financial situation, which includes income, expenses, outstanding debts, and long-term financial goals. Understanding these elements helps determine the appropriate amount of coverage needed to safeguard the financial well-being of dependents in the event of the policyholder’s passing.

Age and health also play pivotal roles in the decision-making process. Younger individuals may find term life insurance appealing, as it provides cost-effective coverage for a specific period. On the other hand, whole life insurance, which lasts a lifetime and accumulates cash value, may be more suitable for those seeking lifelong protection with an investment component.

The choice between term, whole, or universal life insurance depends on individual preferences and financial objectives. Universal life insurance offers flexibility, allowing policyholders to adjust premiums and death benefits as their circumstances change. This adaptability makes it an attractive option for those seeking a more dynamic and personalized life insurance solution.

Seeking guidance from a financial advisor is integral in making an informed decision. An advisor can help individuals navigate the complexities of life insurance policies, considering their unique circumstances and aligning them with the most suitable coverage. By weighing the factors of age, health, financial goals, and personal preferences, individuals can confidently choose a policy that not only meets their immediate needs but also provides long-term financial security for their loved ones.

Researching Insurance Providers

Researching insurance providers is a critical step in the journey of acquiring life insurance, ensuring that individuals choose a reputable and reliable company to safeguard their financial future. The process begins with obtaining quotes from different providers, allowing individuals to compare premiums and coverage options. This comparative analysis is instrumental in identifying the most cost-effective yet comprehensive solution tailored to individual needs.

Customer reviews and ratings serve as valuable insights into the reputation and reliability of an insurance provider. Exploring feedback from other policyholders can reveal the company’s customer service quality, claims processing efficiency, and overall satisfaction levels. It is advisable to consider reviews from multiple sources to form a comprehensive understanding of the provider’s track record.

Additionally, checking the financial stability and ratings of an insurance company is crucial. Independent rating agencies assess the financial strength of insurance providers, giving potential policyholders an indication of the company’s ability to fulfill its financial commitments. Opting for a financially stable provider adds an extra layer of confidence in the reliability of the chosen life insurance policy.

The digital age has facilitated the ease of obtaining information about insurance providers online. Utilizing online platforms and tools enables individuals to streamline the research process and gather relevant data efficiently. In conclusion, a thorough investigation of insurance providers, considering quotes, customer reviews, and financial stability, is indispensable in making an informed decision that aligns with individual preferences and ensures the security of loved ones in the face of life’s uncertainties.

Online Platforms for Life Insurance

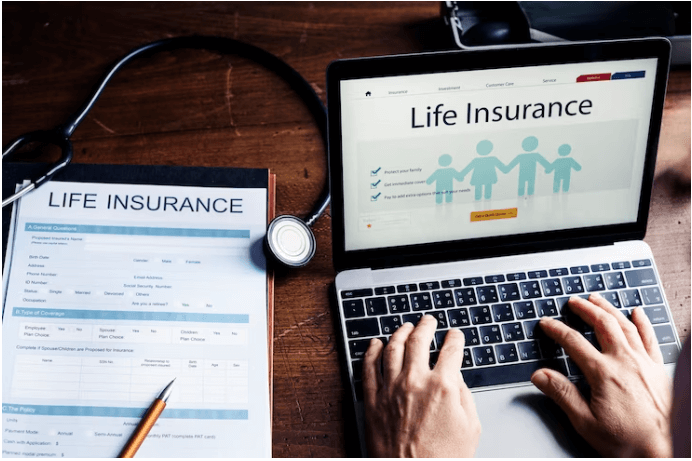

In the contemporary landscape of life insurance, online platforms have emerged as convenient and accessible channels for individuals seeking to secure their financial future. These platforms offer a streamlined and user-friendly experience, allowing users to explore and purchase life insurance policies from the comfort of their homes.

One of the notable advantages of online platforms is the ability to compare quotes effortlessly. Users can input their information once and receive quotes from multiple insurance providers, facilitating a quick and comprehensive assessment of available options. This transparency empowers individuals to make well-informed decisions based on both coverage and cost considerations.

The online application process is another significant feature, providing a hassle-free experience compared to traditional methods. Users can complete the necessary documentation digitally, reducing the time and effort required for policy initiation. Additionally, online platforms often feature interactive tools and resources that guide users through the selection process, ensuring they understand the nuances of different policies before making a commitment.

Moreover, the digitization of life insurance has facilitated faster response times and quicker policy issuance. Online platforms leverage technology to automate underwriting processes, minimizing delays and providing policyholders with swift access to coverage. This speed and efficiency align with the modern consumer’s expectations, making online platforms an attractive choice for those seeking a straightforward and prompt life insurance experience.

In essence, the advent of online platforms has revolutionized the way individuals approach life insurance, offering a blend of convenience, transparency, and efficiency. As technology continues to advance, these platforms are likely to play an increasingly pivotal role in shaping the future of the life insurance industry.

Common Misconceptions about Life Insurance

Life insurance is a financial tool that provides a safety net for loved ones in times of need, yet it often carries with it some common misconceptions. One prevalent misconception is the belief that life insurance is only necessary for older individuals or those with dependents. In reality, the need for life insurance can arise at any age, and it serves as a crucial financial planning tool for individuals looking to secure their family’s future, cover debts, or leave a legacy.

Another misconception involves the belief that life insurance is unaffordable. The truth is that life insurance comes in various types and coverage levels, accommodating a range of budgets. Term life insurance, for instance, is often a cost-effective option for those seeking temporary coverage. Understanding the diverse options available can help individuals find a policy that aligns with their financial capabilities.

There’s also a common myth that single individuals without dependents do not need life insurance. While it’s true that life insurance is often associated with providing for dependents, it can also serve other purposes. For singles, it can cover funeral expenses, outstanding debts, or act as a tool for charitable giving.

Dispelling these misconceptions is crucial for individuals to make informed decisions about life insurance. Education and awareness can empower individuals to recognize the versatility of life insurance and understand how it can be tailored to meet their unique needs, debunking myths and ensuring that this essential financial tool is utilized effectively in their overall financial plan.

Factors Affecting Premiums

When delving into the realm of life insurance, understanding the factors that affect premiums is paramount in making informed decisions. One of the primary influencers is age. Generally, younger individuals are considered lower risk by insurers, resulting in lower premiums. As age increases, the likelihood of health issues also rises, leading to higher premiums. It’s crucial for individuals to recognize that securing life insurance at a younger age can offer more favorable rates.

Health condition is another pivotal factor. Insurers assess an individual’s overall health, considering factors such as pre-existing medical conditions, lifestyle choices, and family medical history. Those with healthier lifestyles often receive more favorable premiums. Individuals with certain health conditions or high-risk lifestyles may face higher premiums or additional underwriting requirements.

Lifestyle choices, such as smoking and excessive alcohol consumption, can significantly impact premiums. Smokers typically face higher rates due to the associated health risks. Likewise, engaging in hazardous activities or occupations may lead to increased premiums, reflecting the elevated risk involved.

The chosen coverage amount and type of policy also influence premiums. Policies with higher coverage amounts or those with additional features, such as cash value accumulation, may come with higher premiums. Term life insurance, offering coverage for a specific term, often comes with lower initial premiums compared to whole or universal life insurance.

Understanding these factors enables individuals to navigate the complexities of life insurance premiums. Making lifestyle adjustments and securing coverage at a younger age can contribute to more affordable premiums, ensuring that the chosen policy aligns with both the individual’s needs and budget.

Applying for Life Insurance

Applying for life insurance is a significant step in securing financial protection for the future, and the process involves several key considerations. To initiate the application, individuals typically need to provide detailed information about their personal and financial background. This may include details about their health, lifestyle, occupation, and financial status. The accuracy and completeness of this information are crucial, as it forms the basis for the underwriting process, where insurers assess the level of risk associated with providing coverage.

The application process often includes a medical examination, which may involve basic health checks and, in some cases, more extensive tests. The results of these examinations play a vital role in determining the individual’s overall health and, consequently, the cost of premiums. It’s essential to be transparent and honest during this phase to ensure the accuracy of the underwriting process.

Documentation requirements can vary among insurance providers, but generally, individuals will need to provide identification documents, financial statements, and any relevant medical records. Some insurers may also request information about beneficiaries and the desired coverage amount.

Upon submitting the necessary information and completing the required examinations, the underwriting process begins. This involves the insurer assessing the risk associated with providing coverage to the applicant. Once approved, the individual receives the terms of the policy, including the coverage amount, premiums, and any additional features.

Navigating the application process with transparency, accuracy, and a clear understanding of the required documentation ensures a smooth and efficient experience. Seeking guidance from insurance professionals can also provide valuable insights, helping individuals make informed decisions about their life insurance coverage.

Waiting Period and Coverage Activation

Understanding the waiting period and coverage activation is essential when venturing into the realm of life insurance. The waiting period refers to the duration between the policy’s initiation and the point at which the coverage becomes fully active. During this period, the policyholder pays premiums, but the insurer may impose restrictions on the payout of the full death benefit. This waiting period is a common feature in certain types of life insurance, particularly those designed for individuals with higher-risk profiles.

The waiting period serves as a risk management measure for insurance providers, allowing them to assess the policyholder’s risk and ensure the integrity of the coverage. It’s crucial for individuals to be aware of the specific terms and conditions regarding the waiting period outlined in their policy documents. Policies with longer waiting periods often come with lower premiums, making them an attractive option for those willing to endure the waiting period for cost savings.

Coverage activation, on the other hand, signifies the point at which the full benefits of the life insurance policy come into effect. This typically occurs after the waiting period has elapsed. Policyholders should carefully review the terms of their policy to understand when the coverage becomes active and under what circumstances.

Comprehending the waiting period and coverage activation is vital for policyholders to set realistic expectations regarding when the full benefits of their life insurance policy will be available. It is advisable to discuss these aspects with the insurance provider and seek clarification on any uncertainties to ensure a clear understanding of the policy’s terms and conditions.

Perplexity in Life Insurance Decisions

Navigating the landscape of life insurance can be perplexing for many individuals, given the myriad of options, complex terminology, and varying policy features. The perplexity often arises from the diverse types of life insurance policies available, each catering to different needs and financial goals. Understanding the distinctions between term life insurance, whole life insurance, and universal life insurance can be challenging, making it crucial for individuals to seek clarity on the nuances of each policy type.

Moreover, the industry is replete with jargon, intricate clauses, and fine print that may leave policyholders bewildered. Terms like cash value, dividends, and riders can add to the perplexity, requiring individuals to invest time in deciphering the intricacies of their chosen policy. Seeking guidance from a financial advisor or insurance professional can be immensely beneficial in demystifying these terms and ensuring a comprehensive understanding.

The need for life insurance often arises during significant life events, such as marriage, the birth of a child, or purchasing a home. These pivotal moments can add an extra layer of complexity as individuals grapple with changing financial responsibilities and evolving priorities. Deciding on the appropriate coverage amount and policy type amidst these life changes requires careful consideration and a clear understanding of the implications.

Addressing perplexity in life insurance decisions involves actively seeking knowledge, asking questions, and collaborating with professionals to unravel the complexities. A transparent and educational approach, coupled with professional guidance, can empower individuals to make informed decisions that align with their unique circumstances and provide the desired financial protection for themselves and their loved ones.

Burstiness in Financial Planning

In the realm of financial planning, the concept of burstiness refers to the ability of a strategy to adapt and respond effectively to sudden changes or unexpected events. Life is inherently unpredictable, and burstiness in financial planning becomes crucial in ensuring that individuals can navigate unforeseen circumstances without compromising their financial well-being.

One area where burstiness is particularly relevant is in life insurance. Life is marked by unpredictable events such as illnesses, accidents, or sudden changes in family dynamics. A well-crafted life insurance plan should exhibit burstiness by providing flexibility and adaptability. For instance, some policies allow for adjustments to coverage amounts or the ability to convert term life insurance into permanent coverage. These features enable policyholders to respond to changing needs without the need for an entirely new policy.

Moreover, burstiness in financial planning involves having contingency plans in place for emergencies. This may include maintaining an emergency fund to cover unexpected expenses, such as medical bills or home repairs. Having liquid assets readily available provides a burst of financial resilience when facing unforeseen challenges.

Investment portfolios also benefit from burstiness, where a diversified approach helps mitigate risks and allows for adjustments based on market fluctuations. The ability to reallocate assets in response to changing market conditions ensures that a financial plan remains robust in the face of economic uncertainties.

Burstiness in financial planning is about creating a strategy that is resilient, flexible, and responsive to life’s unpredictability. Whether in the realm of insurance, emergency funds, or investments, incorporating burstiness ensures that individuals can effectively weather the storms and maintain financial stability in the face of life’s unexpected twists and turns.

Frequently Asked Question

Where do I buy life insurance?

You can buy life insurance from various sources, including insurance companies, independent agents, or online platforms. Research and compare options, considering factors like coverage, premiums, and customer reviews, to find the best policy that suits your needs and preferences.

Where is the best place to get life insurance?

The best place to get life insurance depends on your preferences. Consider reputable insurance companies, independent agents, or online platforms. Research thoroughly, comparing coverage, premiums, and customer reviews to find a reliable provider that aligns with your specific needs and financial goals.

How much does life insurance cost?

The cost of life insurance varies based on factors such as age, health, coverage amount, and policy type. On average, term life insurance can range from $20 to $40 per month, while permanent policies may have higher premiums. It’s essential to get personalized quotes for accurate pricing.

What is the cheapest age to buy life insurance?

The cheapest age to buy life insurance is typically in your 20s or 30s. At this stage, individuals are considered lower risk by insurers, leading to more affordable premiums. As age increases, insurance costs tend to rise due to the higher likelihood of health issues.

Conclusion

Purchasing life insurance is a crucial step toward securing your family’s financial future. The ideal time to buy is in your 20s or 30s, as premiums are more affordable. However, regardless of age, the importance of coverage cannot be overstated. Careful consideration of personal circumstances, coverage needs, and comparison of options will ensure a well-informed decision. Life insurance is an investment in peace of mind, providing a financial safety net for loved ones in times of need.