Where Can I Sell My Life Insurance Policy?

Are you at a crossroads, wondering what to do with your life insurance policy? Life is unpredictable, and sometimes, the financial landscape changes, making you reconsider your investments. One option that might not have crossed your mind is selling your life insurance policy. In this article, we’ll explore the intricacies of selling your life insurance policy, providing you with insights and answers to the question, “Where can I sell my life insurance policy?”

Life insurance is a crucial financial safety net designed to provide for your loved ones after your passing. However, circumstances can change, and the need for your policy may evolve. In such cases, selling your life insurance policy can be a viable option. Let’s delve deeper into the process and the factors you must consider.

Contents

- 1 Why Consider Selling Your Life Insurance Policy?

- 2 Types of Where Can I Sell My Life Insurance Policy

- 3 How To Sell Your Life Insurance Policy

- 4 How Much Money Can You Get for Your Life Insurance Policy?

- 5 Requirements For Selling Your Life Insurance Policy

- 6 Alternative Options for Selling Your Policy

- 7 Frequently Ask Questions

- 8 Conclusion

Why Consider Selling Your Life Insurance Policy?

Before we explore where you can sell your life insurance policy, it’s essential to understand why you might consider this option. Some common reasons include:

- Financial Hardship: Unexpected medical bills, mounting debts, or other financial challenges.

- Changing Needs: Your beneficiaries’ financial requirements may have changed over time.

- Premiums Become Unaffordable: As you age, the cost of your life insurance premiums can increase significantly.

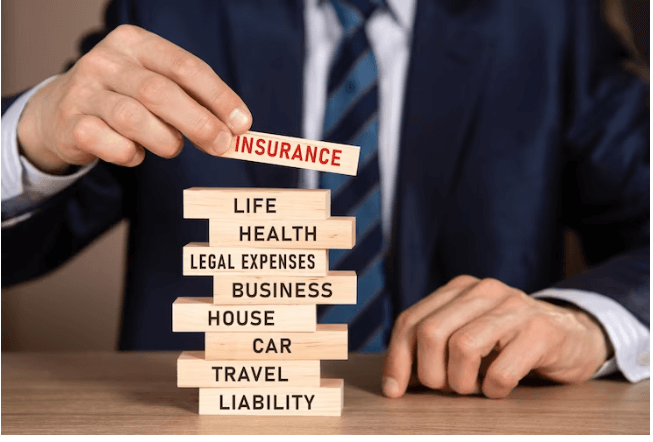

Types of Where Can I Sell My Life Insurance Policy

You can typically sell two types of life insurance policies:

- Term Life Insurance: This policy has no cash value and can’t be sold.

- Permanent Life Insurance: This includes whole life, universal life, and variable life policies, which can be sold.

How To Sell Your Life Insurance Policy

If you want to sell your life insurance policy, start by familiarizing yourself with life settlement transactions and the regulations that govern them. Check with your state’s insurance department for more information about the process, licensing requirements, and potential scams. Next, decide whether to use a broker.

This choice involves a tradeoff between cost and convenience. A licensed life settlement broker can answer your questions, look out for your interests, pull quotes, and handle negotiations. However, a broker will charge for the service. Alternatively, you can choose to shop and compare on your own to avoid broker fees. Regardless of whether you hire a professional, the process will require the same basic steps:

Application:

If you are gathering quotes from multiple companies, you must complete an application for each company. As part of the application process, you must grant the settlement company permission to obtain information about your policy and health. You may also be given disclosures and asked to provide additional information or documentation.

Documentation:

Once you have submitted your application and granted the necessary permissions, the underwriters at the settlement company will begin gathering information. They will contact the life insurance company to request details about your policy, including its death benefit and premiums. They will also request a copy of your medical records from your healthcare providers.

Appraisal:

After reviewing the relevant information, the underwriters will determine the market value of your life insurance policy. They will consider whether your policy is a good investment based on its value and the opinion of medical experts regarding your health. They will also look for signs of fraud.

Offer:

Assuming your policy is deemed suitable for purchase, the settlement company will extend an offer. You can either accept or decline the offer. We recommend comparing offers from multiple companies before making a final decision. If you hire a broker, you may be more able to negotiate for a better offer.

Closing:

If you accept the offer, the settlement provider will send a closing package for you to review and sign. Once you return the signed documents, your insurance provider will be notified of the transaction. Ownership of the policy will change, and you will receive the settlement funds.

How Much Money Can You Get for Your Life Insurance Policy?

It is impossible to predict exactly how much money you can make by selling your life insurance policy, as there is no standard formula or ratio. Every case is different, and the amounts different companies offer vary. However, according to the Life Insurance Settlement Association (LISA), the average life settlement is 20% of the policy’s face value. That means if your policy has a $100,000 benefit, you might receive $20,000 from selling it.

Life settlement companies base their offers on many of the same factors life insurance companies use to determine your premiums. However, factors that work against you when buying a policy often work in your favor when selling it. That’s because life insurance and life settlement companies have opposing interests. The former will pay the death benefit, while the latter hopes to receive it.

Requirements For Selling Your Life Insurance Policy

Once you decide who you’ll work with, you’ll need to provide some basic information about your age, health, and insurance policy to see if you meet the eligibility requirements for a life settlement. This is typically done through an online or over-the-phone screener, more detailed information will be requested later to verify eligibility. The qualifying factors for a life settlement include:

- Type of Policy: Not all life insurance policies can be sold. To qualify for a life settlement, you must have a whole, convertible term, variable, or universal life policy.

- Value of the Policy: In most cases, the face value of your policy must be at least $50,000 to qualify for a life settlement.

- Age of the Policy Owner: People who have reached the age of 70 years or older are most likely to qualify for a life settlement. The older the person is, the more valuable the life settlement becomes.

- Age of the Policy: To sell your life insurance, you must own the policy for a set number of years regulated by the states. Each state has its own waiting period which varies between 2-5 years before you can sell it.

If you meet the above qualifications, you likely qualify for a life settlement. However, even if you don’t meet the qualifications above — you may qualify for a viatical settlement if you were recently diagnosed with a chronic or terminal illness.

If you need help determining your eligibility, contact us today to find out if you qualify and how much your policy is worth. We will guide you step-by-step through the process answering all of your questions and can give you a free estimate of the value of your policy if you are interested.

Alternative Options for Selling Your Policy

If selling your policy isn’t the best choice for you, consider alternative options, such as:

- Borrowing against the policy.

- Reducing the death benefit.

- Surrendering the policy for its cash value.

Frequently Ask Questions

Where Can I sell my life insurance policy?

The price you get from a life settlement depends on a number of factors, such as your life expectancy, your policy’s death benefit, and what you’re paying in premiums.

How much is my life insurance policy worth?

The value of your life insurance refers to the death benefit paid to beneficiaries. To find the cash value of your life insurance, calculate your total payments and subtract surrender fees.

How to make money from life insurance?

One way is to purchase a policy and let the cash value grow over time. Then, when you retire, you can use the cash value to supplement your income. The other way is to purchase a policy and borrow against the cash value.

Is life insurance hard to sell?

Life insurance is a very difficult product to sell. Simply getting your prospect to acknowledge and discuss the fact they are going to die is a hard first step. When and if you clear that hurdle, your next task is creating urgency so they buy right away.

Conclusion

Selling your life insurance policy is a decision that should not be taken lightly. It can provide immediate financial relief, but it also has implications for your beneficiaries. Therefore, weighing the pros and cons, seeking professional guidance, and making an informed choice is crucial. If you find that selling your policy aligns with your current financial needs and goals, proceed with caution and diligence.

.