Where Can I Get Short-Term Disability Insurance In 2024 | An Expert Guide

Imagine a scenario where unforeseen circumstances lead to a temporary inability to work. The bills keep piling up, and the stress becomes overwhelming. This is where Short-Term Disability Insurance becomes a crucial financial lifeline. In this article, we’ll delve into the world of short-term disability insurance, exploring its importance, where to find it, and key considerations in selecting the right coverage.

Contents

- 1 Understanding Where Can I Get Short-Term Disability Insurance?

- 2 Definition of Short-Term Disability Insurance

- 3 Importance of Short-Term Disability Insurance

- 4 Understanding Short-Term Disability Insurance

- 5 Where to Find Short-Term Disability Insurance

- 6 Factors to Consider When Choosing a Short-Term Disability Insurance Provider

- 7 Application Process for Short-Term Disability Insurance

- 8 Common Misconceptions About Short-Term Disability Insurance

- 9 Benefits of Short-Term Disability Insurance

- 10 Tips for Maximizing Short-Term Disability Insurance

- 11 Frequently Asked Questions

- 12 Conclusion

Understanding Where Can I Get Short-Term Disability Insurance?

Short-term disability insurance is a crucial financial safety net for individuals facing temporary health challenges that may hinder their ability to work. Understanding where to obtain short-term disability insurance is essential for those looking to secure this valuable coverage.

One primary avenue for obtaining short-term disability insurance is through employer-sponsored plans. Many companies include this insurance as part of their benefits package, providing employees with a degree of financial protection during periods of temporary disability. It’s advisable for employees to check with their Human Resources department to explore the coverage options available through their workplace.

Private insurance companies also offer standalone short-term disability insurance policies. Individuals can independently research and approach these companies to purchase coverage tailored to their specific needs. Comparison websites dedicated to insurance policies can be valuable resources, allowing individuals to compare different plans from various providers and make informed decisions.

When seeking short-term disability insurance, it’s crucial to consider factors such as premium costs, coverage limits, and waiting periods. Careful evaluation of these aspects ensures that individuals select a policy that aligns with their financial circumstances and provides adequate coverage.

Obtaining short-term disability insurance involves exploring employer-sponsored plans, approaching private insurance companies, and utilizing comparison websites. Being well-informed about the options available and carefully assessing policy details empowers individuals to make decisions that best suit their unique needs and circumstances.

Definition of Short-Term Disability Insurance

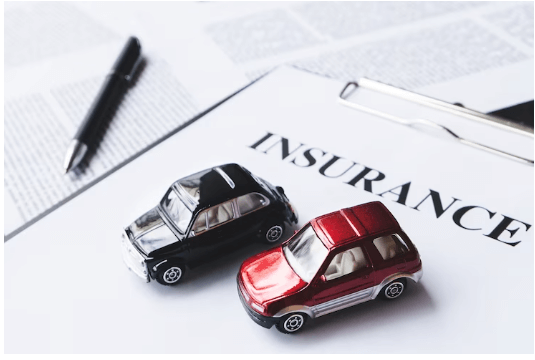

Short-Term Disability Insurance (STD) is a financial protection tool designed to provide individuals with income support during periods of temporary inability to work due to illness, injury, or pregnancy. This type of insurance offers crucial financial assistance to individuals facing short-term health challenges, ensuring they can maintain a degree of financial stability while unable to perform their regular job duties.

The core concept behind Short-Term Disability Insurance is to replace a percentage of an individual’s income during their period of disability. Typically, these policies cover a range of circumstances, including recovery from surgery, illness, or maternity leave. The coverage duration usually spans from a few weeks up to six months, aiming to bridge the financial gap during the individual’s recovery and prevent severe economic strain.

Employers often include Short-Term Disability Insurance as part of their employee benefits package, providing workers with a level of financial security in case of unexpected health issues. Employees should familiarize themselves with the eligibility criteria and coverage details of their employer-sponsored plans.

Private insurance companies also offer standalone Short-Term Disability Insurance policies, allowing individuals to independently purchase coverage tailored to their needs. Understanding the specifics of these policies, including waiting periods, coverage limits, and documentation requirements, is crucial for making informed decisions about obtaining short-term disability insurance. In essence, Short-Term Disability Insurance serves as a vital safety net, offering peace of mind and financial support during temporary periods of health-related work interruptions.

Importance of Short-Term Disability Insurance

The importance of Short-Term Disability Insurance (STD) cannot be overstated in the realm of financial well-being. This form of insurance plays a pivotal role in safeguarding individuals and their families during times of unexpected health challenges, providing a crucial buffer against the financial strains associated with temporary inability to work.

First and foremost, Short-Term Disability Insurance offers a sense of financial security to individuals facing sudden health crises. In the face of unforeseen illnesses, injuries, or even maternity-related absences, this coverage ensures that individuals continue to receive a portion of their income, mitigating the immediate impact on their financial stability. This financial support becomes particularly significant when medical expenses and other related costs start accumulating.

Peace of mind is another critical aspect of the importance of Short-Term Disability Insurance. Knowing that there is a safety net in place during periods of temporary disability allows individuals to focus on their recovery without the added stress of financial uncertainty. This mental reassurance contributes to a smoother and more effective recuperation process.

Furthermore, Short-Term Disability Insurance acts as a preventive measure against financial strain. Without this coverage, individuals might be forced to dip into their savings, accumulate debt, or face other financial hardships due to the loss of income during their period of disability. The insurance acts as a financial cushion, preventing these adverse consequences and allowing individuals to navigate through challenging times without compromising their overall financial health.

In essence, the importance of Short-Term Disability Insurance lies in its ability to provide not just financial assistance but also peace of mind, ensuring that individuals can face temporary health challenges without the additional burden of economic uncertainties. It stands as a valuable component of comprehensive financial planning, offering a layer of protection against the unexpected twists of life.

Understanding Short-Term Disability Insurance

Understanding Short-Term Disability Insurance (STD) is essential for individuals seeking financial protection during temporary health challenges. This form of insurance serves as a critical safety net, offering income support when individuals are unable to work due to illness, injury, or pregnancy.

One key aspect of comprehending Short-Term Disability Insurance is recognizing the eligibility criteria. Many employers provide this insurance as part of their benefits package, and employees must meet specific criteria, such as tenure or hours worked, to qualify. Additionally, private insurance companies offer standalone policies, allowing individuals to independently secure coverage based on their unique circumstances.

Coverage details are another fundamental aspect to grasp. Short-Term Disability Insurance typically covers a percentage of the individual’s salary during the period of disability. This coverage extends to various scenarios, including medical leave for illness, post-surgery recovery, and maternity leave. Understanding the scope of coverage is crucial in selecting a policy that aligns with the individual’s needs.

Duration of benefits is a critical factor in Short-Term Disability Insurance. Policies usually provide coverage for a few weeks up to six months, with the aim of assisting individuals during their recovery period. It’s important to carefully consider the duration to ensure that the chosen policy offers adequate support based on potential health challenges.

Understanding Short-Term Disability Insurance involves familiarizing oneself with eligibility criteria, comprehending coverage details, and recognizing the duration of benefits. Whether obtained through an employer-sponsored plan or a private insurance company, having a clear understanding of these aspects empowers individuals to make informed decisions, ensuring financial protection during times of temporary inability to work.

Where to Find Short-Term Disability Insurance

When considering Short-Term Disability Insurance (STD), it’s crucial to know where to find this valuable coverage, as it serves as a financial lifeline during temporary periods of inability to work. Here are the primary avenues to explore when seeking Short-Term Disability Insurance:

One prevalent source of Short-Term Disability Insurance is through employer-sponsored plans. Many companies offer this coverage as part of their employee benefits package. Employees should reach out to their Human Resources department to understand the specific details of the coverage provided by their employer. This avenue is convenient for individuals as it often involves seamless enrollment and direct payroll deductions.

Private insurance companies also play a significant role in providing Short-Term Disability Insurance. Individuals who do not have access to employer-sponsored plans or wish to explore additional coverage options can independently approach these insurance providers. Researching and comparing policies from different companies is crucial to finding a plan that aligns with one’s specific needs and financial circumstances.

For those who prefer a comprehensive overview of available options, there are online platforms known as comparison websites. These websites specialize in comparing various insurance policies, including Short-Term Disability Insurance. Users can input their preferences and requirements, and the platform generates a list of policies from different providers, facilitating a side-by-side comparison.

Individuals can find Short-Term Disability Insurance through employer-sponsored plans, private insurance companies, and online comparison websites. Each avenue offers unique advantages, allowing individuals to choose the approach that best suits their preferences and circumstances. Understanding these options empowers individuals to make informed decisions when securing this essential form of insurance.

Factors to Consider When Choosing a Short-Term Disability Insurance Provider

When navigating the landscape of Short-Term Disability Insurance (STD), a thoughtful evaluation of key factors is paramount to secure coverage that not only fits one’s budget but also provides comprehensive protection during times of temporary incapacity.

Premium Costs

The financial commitment involved in Short-Term Disability Insurance begins with the consideration of premium costs. While the cost is undoubtedly a significant factor, it is equally crucial to scrutinize the overall value of the coverage offered. Opting for lower premiums might seem appealing at first glance, but it’s imperative to recognize that they could be accompanied by higher deductibles or reduced benefits. Striking a balance between the cost of premiums and the level of coverage ensures that individuals not only stay within their budget constraints but also receive adequate financial support when confronted with a temporary inability to work.

Coverage Limits

Understanding the coverage limits is a fundamental aspect of choosing a Short-Term Disability Insurance provider. Policies may impose caps on the maximum benefit amount or limit the coverage period. Thoroughly comprehending these details empowers individuals to select a plan that aligns with their specific needs. Whether the goal is to cover medical expenses, replace a portion of income, or address everyday living costs during a disability period, knowing the extent of the coverage is essential for making an informed decision.

Waiting Periods

Short-Term Disability Insurance typically involves a waiting or elimination period before benefits become active. The duration of this waiting period can vary between policies and providers. Being aware of this timeframe is crucial for individuals planning their finances during a period of temporary incapacity. Whether it’s managing essential bills, sustaining day-to-day living expenses, or covering medical costs, understanding and preparing for the waiting period is integral to avoid financial strain during this initial phase.

In conclusion, selecting a Short-Term Disability Insurance provider demands a holistic consideration of premium costs, coverage limits, and waiting periods. Balancing financial affordability with comprehensive coverage ensures that individuals are not only protected against unforeseen health challenges but are also equipped with a robust financial safety net during times of temporary disability. Careful consideration of these factors empowers individuals to make well-informed choices in their quest for the right Short-Term Disability Insurance coverage.

Application Process for Short-Term Disability Insurance

Navigating the application process for Short-Term Disability Insurance (STD) is a crucial step in securing financial protection during periods of temporary inability to work. Understanding the intricacies of this process is essential for a smooth and efficient experience. The application process typically begins with gathering the necessary documentation.

This may include medical records, statements from healthcare providers, and any other relevant paperwork. Ensuring that all required documentation is complete and accurate is crucial, as it forms the basis for evaluating the validity of the claim.

In some instances, insurance providers may require a medical examination as part of the application process. This examination helps assess the individual’s current health status and ensures that the coverage aligns with their specific needs. Being prepared for this step can streamline the process and contribute to a more expedited application review.

Once all documentation is in order, the next step involves submitting the application to the insurance provider. The approval process varies, and individuals should be aware of the expected timeframes. Some policies may have specific waiting periods even after approval, and understanding these details is essential for effective financial planning during the disability period.

An integral part of the application process is prompt reporting of the disability. Delaying the reporting of the disability may lead to delays in receiving benefits, potentially causing financial strain. Therefore, individuals should be proactive in reporting their inability to work, ensuring a smoother and more efficient claims process.

The application process for Short-Term Disability Insurance involves gathering necessary documentation, potential medical examinations, and prompt reporting of the disability. Understanding each step and adhering to the requirements ensures a seamless experience, allowing individuals to access the financial support they need during temporary periods of incapacity.

Common Misconceptions About Short-Term Disability Insurance

Common misconceptions about Short-Term Disability Insurance (STD) often circulate, leading to a lack of understanding about the true benefits and limitations of this valuable coverage. Dispelling these myths is crucial for individuals to make informed decisions when considering STD insurance.

One prevailing misconception is the lack of clarity regarding policy exclusions. It’s essential for individuals to understand that certain pre-existing conditions or specific types of injuries may not be covered under their STD policy. Thoroughly reviewing the policy details and seeking clarification from the insurance provider ensures that individuals are aware of any potential exclusions, preventing surprises when filing a claim.

Another misconception involves the assumption that all policies are the same. In reality, STD insurance policies can vary significantly between providers. From coverage limits to waiting periods, each policy has its unique features. Recognizing these differences allows individuals to select a policy that aligns with their specific needs, providing a tailored approach to financial protection during temporary periods of inability to work.

Additionally, there’s often confusion surrounding the importance of reading policy details. Some individuals may assume that the general concept of STD insurance remains consistent across policies, leading them to overlook the fine print. Taking the time to thoroughly understand the terms and conditions ensures that individuals are well-informed about their coverage, fostering a more transparent and trustworthy relationship with their insurance provider.

In conclusion, addressing common misconceptions about Short-Term Disability Insurance involves dispelling myths about policy exclusions, recognizing the variability between policies, and emphasizing the importance of reading and understanding policy details. By debunking these misconceptions, individuals can approach STD insurance with a clearer understanding, making choices that align with their financial needs and expectations during times of temporary incapacity.

Benefits of Short-Term Disability Insurance

The benefits of Short-Term Disability Insurance (STD) extend far beyond just financial compensation during periods of temporary incapacity. This form of insurance serves as a crucial component of comprehensive financial planning, offering a range of advantages to individuals and their families.

One of the primary benefits of STD insurance is the assurance of financial security during health crises. When unforeseen circumstances, such as illness, injury, or pregnancy, render individuals unable to work temporarily, STD insurance steps in to provide a percentage of their income. This financial support alleviates the immediate strain on individuals and their families, allowing them to focus on recovery without the added burden of financial worries.

Peace of mind is another significant advantage of STD insurance. Knowing that there is a safety net in place in case of a health-related work interruption brings a sense of security. This peace of mind is invaluable during times of uncertainty, contributing to an overall smoother and more effective recovery process.

STD insurance also acts as a preventive measure against financial strain. Without this coverage, individuals may have to dip into savings, accumulate debt, or face other financial hardships during a period of temporary incapacity. The insurance serves as a financial cushion, preventing individuals from depleting their financial resources and ensuring a more stable financial foundation.

In conclusion, the benefits of Short-Term Disability Insurance encompass financial security during health crises, peace of mind for individuals and their families, and prevention of financial strain. This coverage goes beyond mere compensation, playing a vital role in supporting individuals during challenging times and contributing to their overall well-being. Investing in STD insurance is a proactive step towards ensuring financial stability and peace of mind during temporary periods of incapacity.

Tips for Maximizing Short-Term Disability Insurance

Maximizing the benefits of Short-Term Disability Insurance (STD) involves not only understanding the policy but also adopting proactive strategies to make the most of the coverage during times of temporary incapacity. Here are some tips for individuals to optimize their experience with STD insurance:

- Know Your Policy Inside Out: Familiarize yourself with the details of your STD policy, including coverage limits, waiting periods, and any specific conditions or exclusions. This knowledge empowers you to make informed decisions and avoid surprises when filing a claim.

- Prompt Reporting of Disability: Report your disability to the insurance provider promptly. Delays in reporting can lead to delays in receiving benefits, causing unnecessary financial strain. Be proactive in initiating the claims process as soon as you are aware of your inability to work.

- Stay Informed About Policy Updates: Insurance policies may undergo updates or changes. Stay informed about any modifications to your STD policy to ensure you are aware of any adjustments to coverage, waiting periods, or benefit amounts.

- Understand the Application Process: If you haven’t obtained STD insurance yet, thoroughly understand the application process. Gather all necessary documentation, be prepared for potential medical examinations, and submit your application accurately and on time.

- Explore Return-to-Work Programs: Some STD insurance providers offer return-to-work programs. These initiatives aim to facilitate a smooth transition back to work after a period of disability. Explore whether such programs are available and how they can benefit your situation.

- Stay Proactive During Recovery: Utilize the support services provided by your STD insurance, such as rehabilitation programs or counseling services. Staying proactive during your recovery can contribute to a quicker and more successful return to work.

By implementing these tips, individuals can maximize the effectiveness of their Short-Term Disability Insurance, ensuring a more seamless and supportive experience during temporary periods of incapacity.

Frequently Asked Questions

Where can I get short term disability insurance?

Short-Term Disability Insurance can be obtained through employer-sponsored plans, private insurance companies, and online platforms offering comparison services. Employers often provide this coverage, but individuals can also explore standalone policies from private insurers or use online platforms for comprehensive policy comparisons.

Who is eligible for short term disability?

Eligibility for short-term disability varies but often includes employees with an active employment status, meeting specific criteria such as tenure or hours worked. Individuals may also independently purchase coverage, and eligibility criteria depend on the insurance provider and policy terms.

How does short term disability work?

Short-term disability provides income replacement when individuals cannot work due to illness, injury, or pregnancy. Typically, individuals receive a percentage of their salary for a predetermined period, helping them financially during recovery. The process involves filing a claim with the insurance provider.

How to apply for short-term disability?

To apply for short-term disability, gather necessary documentation, such as medical records. Submit the completed application to the insurance provider, potentially undergoing a medical examination. Promptly report the disability, adhere to waiting periods, and stay informed about the application process for a smoother experience.

Conclusion

Short-term disability insurance is a vital component of financial planning, providing security and peace of mind during challenging times. By understanding where to find coverage, what factors to consider, and how to navigate the application process, individuals can ensure they have a robust safety net in place. Investing time in understanding the policy details and dispelling common misconceptions enhances the overall effectiveness of short-term disability insurance.