Where Can I Get Pet Insurance In 2024 | An Expert Guide

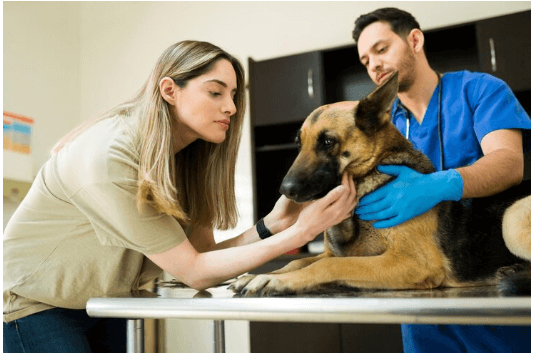

In a world where our furry friends are cherished family members, ensuring their well-being becomes a top priority. Pet insurance emerges as a crucial safeguard against unexpected veterinary expenses, offering a safety net for pet owners. Let’s delve into the intricacies of pet insurance, answering the common question – where can I get pet insurance?

Contents

- 1 Where can I get pet Insurance?

- 2 Definition of Pet Insurance

- 3 Importance of Pet Insurance

- 4 Understanding Pet Insurance

- 5 Choosing the Right Pet Insurance

- 6 Common Misconceptions

- 7 Benefits of Pet Insurance

- 8 Factors Influencing Pet Insurance Cost

- 9 How to Make a Claim

- 10 Customer Testimonials

- 11 Pet Insurance for Exotic Pets

- 12 Trends in Pet Insurance

- 13 Tips for Keeping Premiums Low

- 14 Future of Pet Insurance

- 15 FAQs

- 16 Conclusion

Where can I get pet Insurance?

Pet insurance is widely available through various providers, offering coverage to pet owners seeking financial protection for their furry companions. One common source for pet insurance is specialized pet insurance companies, such as Healthy Paws, Tropaion, and Embrace. These companies focus exclusively on pet insurance, tailoring their policies to address the unique healthcare needs of animals. They typically offer a range of coverage options, including accident and illness coverage, as well as optional add-ons like wellness plans for routine care.

Additionally, many traditional insurance companies have recognized the growing demand for pet insurance and have incorporated it into their product offerings. These companies often provide the convenience of bundling pet insurance with other insurance policies, such as homeowners or auto insurance, allowing pet owners to manage their various coverage needs in one place.

Veterinary clinics and animal hospitals may also partner with or recommend specific pet insurance providers to their clients. Some veterinary practices collaborate with insurance companies to facilitate the claims process and streamline reimbursement for pet owners.

Online platforms dedicated to insurance comparison and purchasing, like Pet Insurer or Pet Insurance Review, are valuable resources for individuals looking to explore multiple pet insurance options. These platforms allow users to compare coverage, premiums, and customer reviews, helping them make informed decisions based on their specific needs and preferences.

Pet insurance can be obtained from specialized pet insurance companies, traditional insurance providers, veterinary clinics, and online comparison platforms. Exploring different options and comparing policies can help pet owners find the most suitable coverage for their pets’ healthcare needs.

Definition of Pet Insurance

Pet insurance is a financial product designed to assist pet owners in managing the costs associated with the healthcare of their animal companions. Similar to health insurance for humans, pet insurance provides coverage for a range of veterinary services, encompassing treatments for illnesses, injuries, surgeries, medications, and preventive care. Pet owners pay regular premiums to the insurance provider, and in return, they receive reimbursement for eligible veterinary expenses, as specified in the terms of their policy.

The primary goal of pet insurance is to alleviate the financial burden that can arise from unexpected and often costly veterinary procedures. In the event of accidents, illnesses, or routine care, pet insurance ensures that pet owners can provide necessary medical attention without facing overwhelming financial strain. This financial support promotes responsible pet ownership by encouraging pet owners to seek timely veterinary care, ultimately contributing to the overall health and well-being of their pets.

Pet insurance plans can vary widely, offering different levels of coverage, deductibles, and premiums. Some policies may focus on specific areas of care, such as accidents, illnesses, or routine wellness exams, allowing pet owners to choose a plan that aligns with their pet’s specific needs and their budget.

In essence, pet insurance serves as a safety net, allowing pet owners to make informed decisions about their pets’ healthcare based on medical needs rather than financial constraints. As the bond between pets and their owners continues to deepen, the importance and prevalence of pet insurance as a tool for ensuring comprehensive and accessible veterinary care have grown significantly.

Importance of Pet Insurance

Pet insurance holds significant importance in safeguarding the well-being of pets and easing the financial burden on their owners. One of the key aspects of its importance lies in providing financial support for unexpected veterinary expenses. Pets, like humans, can face accidents, injuries, or illnesses that require medical attention, and the associated costs can be substantial. Pet insurance ensures that pet owners can afford necessary treatments without compromising on the quality of care.

Furthermore, the availability of pet insurance promotes responsible pet ownership. Knowing that they have financial assistance for veterinary care encourages pet owners to seek timely medical attention for their animals, preventing health issues from escalating. This proactive approach to healthcare contributes to the overall health and longevity of pets.

Pet insurance also enables pet owners to make decisions based on their pets’ health needs rather than financial constraints. This can be particularly crucial in situations where advanced or emergency medical treatments are required. The peace of mind provided by pet insurance allows pet owners to focus on the well-being of their animals without the added stress of potential financial strain.

Moreover, as veterinary medicine advances, the costs of specialized treatments and procedures for pets can rise. Pet insurance helps bridge the gap between the growing sophistication of veterinary care and the financial resources available to pet owners.

The importance of pet insurance is evident in its role as a financial safety net, promoting responsible pet ownership, facilitating timely medical interventions, and ensuring that pets receive the care they need to lead healthy and fulfilling lives.

Understanding Pet Insurance

Pet insurance is a specialized financial product designed to assist pet owners in managing the costs associated with veterinary care for their animals. Similar to health insurance for humans, pet insurance provides coverage for a variety of veterinary services, including treatment for illnesses, injuries, surgeries, medications, and preventive care.

Pet owners typically pay a monthly or annual premium to the insurance provider. In return, they can seek reimbursement for eligible veterinary expenses, depending on the terms and coverage of their policy. Coverage may vary widely, from comprehensive plans that include a broad range of services to more specific plans focusing on accidents, illnesses, or routine wellness care.

The primary purpose of pet insurance is to alleviate the financial burden that can arise from unexpected veterinary expenses. In the event of accidents or illnesses, pet insurance ensures that pet owners can provide necessary medical care without facing significant financial strain. This financial support encourages timely and appropriate interventions, contributing to the overall health and well-being of pets.

Pet insurance also promotes responsible pet ownership by encouraging regular veterinary visits and preventive care. Many policies cover routine check-ups, vaccinations, and other preventive measures, fostering a proactive approach to pet healthcare.

It’s essential for pet owners to carefully review policy details, including coverage limits, deductibles, and exclusions, to choose a plan that aligns with their pet’s needs and their budget. Understanding the terms and conditions of pet insurance allows owners to make informed decisions, ensuring that they can provide the best possible care for their cherished animal companions.

Choosing the Right Pet Insurance

Choosing the right pet insurance is a crucial decision that requires careful consideration of various factors to ensure comprehensive coverage and value for money. To make an informed choice, pet owners should assess their specific needs and their pet’s health requirements.

Firstly, it’s essential to understand the coverage options offered by different policies. Some plans focus on accidents and illnesses, while others may include routine wellness care. Consider your pet’s age, breed, and any pre-existing conditions to select coverage that addresses their unique healthcare needs.

Examine policy limits and annual maximums, as these can impact the overall value of the insurance. Ensure that the coverage limits are sufficient to handle potential high-cost veterinary treatments or procedures that your pet may require.

Evaluate the deductible structure of the policy. A deductible is the amount you must pay before the insurance coverage kicks in. Higher deductibles often result in lower premiums, but it’s crucial to strike a balance that aligns with your budget while providing adequate coverage.

Consider the reimbursement percentage, which determines how much of the eligible expenses the insurance will cover after the deductible is met. Common reimbursement percentages range from 70% to 90%, and choosing a higher percentage can reduce out-of-pocket expenses.

Review the waiting periods for coverage to become effective, as some policies may have waiting periods for certain conditions or procedures. Understand any exclusions and restrictions to avoid surprises when filing a claim.

Lastly, read customer reviews and testimonials to gauge the satisfaction of other pet owners with a particular insurance provider. A reliable and responsive customer service team is crucial for a smooth claims process.

By carefully evaluating these factors and comparing policies, pet owners can choose the right insurance plan that aligns with their pet’s health needs and their budget, providing peace of mind and ensuring access to quality veterinary care.

Common Misconceptions

Pet insurance, a valuable resource for ensuring your furry friend’s well-being, often falls victim to misconceptions that can deter pet owners from exploring its benefits. Let’s debunk some common myths surrounding pet insurance to provide a clearer understanding:

Costly Premiums

Myth: Many believe that pet insurance premiums are prohibitively expensive.

Reality: Pet insurance offers a range of plans, allowing owners to find affordable options tailored to their budget.

Limited Coverage

Myth: Some think that pet insurance only covers basic veterinary care.

Reality: Comprehensive plans exist, covering everything from routine check-ups to emergency surgeries, providing extensive protection.

Pre-existing Conditions Exclusion

Myth: There’s a misconception that pre-existing conditions are never covered.

Reality: While pre-existing conditions may pose challenges, some insurers offer coverage for certain conditions after a waiting period.

Difficulty Making Claims

Myth: People often fear a complex and time-consuming claims process.

Reality: Understanding your insurer’s procedures can streamline the claim process, ensuring prompt reimbursement.

Age and Breed Restrictions

Myth: Older pets or specific breeds may face difficulty obtaining coverage.

Reality: While age and breed can influence premiums, many insurers offer coverage for pets of all ages and breeds.

Limited Provider Options

Myth: Some believe there are only a few pet insurance providers.

Reality: The market is diverse, with numerous reputable providers offering various plans to cater to different needs.

Pet Wellness Exclusions

Myth: Wellness and preventive care aren’t covered.

Reality: Some plans include wellness coverage, promoting proactive pet care.

Dispelling these misconceptions is crucial for pet owners to make informed decisions about their pets’ health. Understanding the true nature of pet insurance ensures that more furry companions receive the care they deserve without unnecessary financial strain.

Benefits of Pet Insurance

Pet insurance goes beyond being a financial safety net; it’s a key to ensuring your beloved companions lead happy, healthy lives. Let’s explore the myriad benefits that come with having pet insurance:

Financial Security

Pet insurance acts as a reliable financial shield, ensuring that your beloved furry companion receives the best possible care without the strain of unexpected veterinary expenses. This crucial safety net covers routine check-ups, vaccinations, and unforeseen medical emergencies. By providing financial security, pet insurance allows pet owners to make decisions based on the well-being of their pets rather than financial constraints. It’s a wise investment that not only safeguards your pet’s health but also provides peace of mind, fostering a strong bond between you and your cherished companion.

Peace of Mind

Pet insurance goes beyond mere coverage; it bestows a profound sense of peace of mind. Knowing that your furry companion is protected from unexpected veterinary expenses allows you to focus on their well-being without the weight of financial worry. This emotional reassurance creates a harmonious environment, fostering a deeper connection between pet and owner. With peace of mind, pet owners can navigate their companions’ health journey confidently, ensuring that every decision is driven by care and love rather than financial strain. Pet insurance becomes not just a policy but a sanctuary of tranquility for both pets and their devoted owners.

Comprehensive Coverage

Pet insurance offers more than just a safety net; it extends to comprehensive coverage, ensuring your furry friend receives top-tier care. This all-encompassing protection spans routine check-ups, vaccinations, and unforeseen emergencies, providing a holistic shield against various health challenges. Comprehensive coverage means that, regardless of the situation, your pet’s well-being is prioritized. It aligns with the diverse needs of pets, offering peace of mind to owners who seek an all-inclusive solution. With pet insurance, you’re not just safeguarding against the unexpected; you’re embracing a level of care that considers every aspect of your cherished companion’s health journey.

Customization Options

Pet insurance isn’t one-size-fits-all; it’s a realm of possibilities with customization at its core. This unique feature allows pet owners to tailor coverage to their specific companion’s needs. Whether you have a playful puppy or a senior cat, customization options empower you to choose the level of protection that aligns perfectly with your pet’s unique requirements. This flexibility ensures that your pet receives targeted care without unnecessary coverage, making pet insurance not just a policy but a personalized plan crafted for your furry friend’s well-being. Customization is the key to unlocking tailored protection for your cherished companion.

Preventive Care Incentives

Pet insurance goes beyond reactive coverage; it actively encourages preventive care through innovative incentives. Some plans include coverage for preventive measures like vaccinations, regular check-ups, and dental care. By providing incentives for proactive wellness, pet insurance not only addresses current health needs but also strives to prevent future issues. This approach not only supports the overall health of your furry companion but also emphasizes the importance of staying ahead in veterinary care. Preventive care incentives transform pet insurance into a tool for proactive well-being, promoting a healthier, happier life for your cherished pet.

Emotional Support

Beyond financial security, pet insurance serves as a pillar of emotional support for pet owners. Dealing with a sick or injured pet is emotionally challenging, and knowing that you have financial assistance eases this burden. By alleviating the stress of potential financial strain, pet insurance allows owners to focus on providing comfort and care for their furry companions during difficult times. This emotional reassurance not only strengthens the bond between pet and owner but also transforms pet insurance into a compassionate companion, standing beside you in moments when your beloved pet needs you the most.

Ease of Claim Process

Pet insurance doesn’t just promise coverage; it delivers a hassle-free experience through an efficient claim process. Most providers offer streamlined procedures, simplifying the submission and approval of claims. Understanding the requirements and steps involved ensures a seamless experience for pet owners. The ease of the claim process translates to quicker reimbursements, allowing pet owners to focus on their furry friend’s recovery rather than bureaucratic hurdles. This user-friendly approach makes pet insurance not only a financial safety net but also a practical and accessible solution for managing your pet’s healthcare expenses with convenience and peace of mind.

Security for Future Health Concerns

Investing in pet insurance isn’t just about the present; it’s a commitment to safeguarding your pet’s future health. By securing coverage early, you ensure that potential health concerns are preemptively addressed. This foresight offers a comprehensive safety net, guaranteeing that your furry companion receives the necessary care throughout their life. Whether it’s routine check-ups or unforeseen medical issues, pet insurance becomes a proactive measure, providing financial security for the evolving health needs of your cherished pet. Embrace the peace of mind that comes with knowing you’ve laid a foundation for a healthy and happy future for your furry friend.

In essence, pet insurance is more than a financial investment; it’s a commitment to your pet’s well-being. The benefits extend beyond the monetary value, creating a foundation for a healthier and happier life for your cherished companion.

Factors Influencing Pet Insurance Cost

The cost of pet insurance is influenced by various factors that can vary from one policy to another. Understanding these factors is essential for pet owners seeking coverage that suits their budget while meeting their pets’ healthcare needs.

Age and breed

A pet’s age and breed are significant factors influencing pet insurance costs. Younger animals typically have lower premiums, reflecting lower perceived risks of health issues. Older pets may face higher premiums due to the increased likelihood of age-related health concerns. Additionally, certain breeds may have predispositions to specific medical conditions, impacting insurance costs. Insurers assess these factors to determine the pet’s risk profile, influencing the overall pricing of the policy. Pet owners should consider these elements when selecting insurance coverage, balancing cost considerations with the unique health needs associated with their pet’s age and breed.

Coverage type

The type of coverage is a crucial factor influencing pet insurance costs. Comprehensive plans covering accidents, illnesses, and preventive care generally result in higher premiums due to broader protection. Limited coverage plans, focusing on specific areas, may offer lower premiums but might not provide as much financial support in various health scenarios. Pet owners should carefully evaluate their pet’s healthcare needs and risk factors to determine the appropriate coverage type. Balancing the desired level of protection with budget considerations ensures that pet insurance meets the specific health requirements of the animal while remaining financially viable for the owner.

Location

Geographic location plays a role in influencing pet insurance costs. The cost of veterinary care can vary based on regional living expenses, affecting insurance premiums. Urban areas or regions with higher living costs may experience elevated veterinary expenses, leading to higher insurance rates. Pet owners should be aware that the location factor is considered by insurers when determining the overall cost of coverage. Understanding these regional variations helps pet owners anticipate potential differences in insurance premiums and make informed decisions based on both their location and the specific healthcare needs of their pets.

Deductible and Reimbursement Levels

The deductible and reimbursement levels significantly impact pet insurance costs. A deductible is the amount the pet owner must pay before the insurance coverage kicks in. Policies with higher deductibles often have lower premiums, but they require greater out-of-pocket expenses. Reimbursement levels, representing the percentage of covered expenses paid by the insurance, also influence costs. Higher reimbursement levels lead to lower out-of-pocket expenses for the pet owner but usually result in higher premium payments. Pet owners should carefully assess their financial preferences and risk tolerance when choosing deductible and reimbursement levels to tailor coverage to their budget and needs.

Pre-Existing Conditions

Pre-existing conditions are a critical factor influencing pet insurance costs. Pets with pre-existing health issues may face higher premiums or exclusions from certain coverage. Insurers evaluate the pet’s medical history to assess the risk and potential costs associated with existing conditions. While some policies may cover pre-existing conditions after a waiting period, others may impose permanent exclusions. Pet owners should thoroughly understand the policy’s approach to pre-existing conditions, as it significantly impacts the cost-effectiveness and coverage of the insurance plan. Selecting a policy that addresses pre-existing conditions appropriately ensures transparency and meets the pet’s healthcare needs.

Claim History

A pet’s claim history plays a crucial role in determining pet insurance costs. Insurance premiums can be influenced by the pet owner’s track record of claims. If a pet has a history of frequent or high-cost claims, insurers may adjust premiums accordingly to reflect the perceived higher risk. A positive claim history, with fewer or less costly claims, may result in lower premiums. Pet owners should be aware that insurers consider past claims when determining future coverage costs, emphasizing the importance of responsible pet ownership and proactive healthcare measures to manage insurance expenses effectively.

Annual Limits

Annual limits are a key factor influencing pet insurance costs. These limits represent the maximum amount an insurance policy will pay for covered expenses in a single year. Policies with higher annual limits often have higher premiums. Understanding the annual limit is crucial, as it impacts the overall financial protection the insurance provides. While higher limits offer more extensive coverage, they may come with increased costs. Pet owners should carefully evaluate their pet’s potential healthcare needs and budget considerations to select an insurance policy with an annual limit that aligns with their financial goals and the well-being of their furry companions.

Add-Ons and Optional Coverages

Add-ons and optional coverages are influential in determining pet insurance costs. These additional features, such as dental care, alternative therapies, or boarding fees, can increase premiums. Pet owners should carefully consider whether these extras are necessary for their pet’s well-being and if they align with their budget. While these options enhance the comprehensiveness of coverage, they may also contribute to higher overall insurance expenses. Selecting add-ons should be a deliberate decision, balancing the desire for extended protection with the financial feasibility of including these optional coverages in the insurance policy for the pet’s optimal care.

By considering these factors, pet owners can make informed decisions when selecting a pet insurance policy that balances cost-effectiveness with comprehensive coverage tailored to their pet’s health needs.

How to Make a Claim

Making a claim on your pet insurance involves several steps to ensure a smooth and efficient process. Here’s a general guide:

Review Your Policy

Before making a pet insurance claim, thoroughly review your policy to understand coverage details, deductibles, and any waiting periods. Familiarize yourself with the specific terms and conditions, including covered services and exclusions. This step ensures you have a clear understanding of what is eligible for reimbursement and helps streamline the claims process. Being informed about the nuances of your policy facilitates a smoother experience when submitting claims, minimizing the likelihood of misunderstandings and ensuring that you maximize the benefits available under your pet insurance coverage.

Keep Records

Maintaining comprehensive records is crucial for a smooth pet insurance claim process. Keep organized documentation of your pet’s medical history, including invoices, receipts, and relevant paperwork from veterinary visits. Clear, detailed records help substantiate your claim and provide the necessary information about diagnoses, treatments, and costs. Having these documents readily available expedites the claims process, reducing the likelihood of delays or complications. Whether in digital or physical format, these records serve as a vital resource when communicating with your insurance provider and contribute to a transparent and efficient experience when seeking reimbursement for your pet’s health care expenses.

Notify the Insurer

Promptly notifying your insurer is a crucial step when making a pet insurance claim. In the event of an incident or illness, adhere to any specified reporting timeframes outlined in your policy. Inform your insurer as soon as possible, providing details about the nature of the incident or illness. This proactive communication allows the insurer to initiate the claims process promptly. Whether through online portals, email, or traditional methods, timely notification sets the groundwork for a smooth and efficient claims experience, demonstrating your commitment to fulfilling the necessary reporting obligations outlined in your pet insurance policy.

Gather Documentation

Gathering comprehensive documentation is essential when preparing a pet insurance claim. Collect all relevant paperwork, including veterinary invoices, itemized bills, and medical records. Ensure these documents clearly outline the diagnosis, treatment, and associated costs. Thorough and organized documentation serves as evidence to support your claim, providing the necessary details for the insurer to assess eligibility for reimbursement. This step is crucial for a transparent and efficient claims process, helping to avoid delays and ensuring that you have all the necessary information readily available when submitting your pet insurance claim.

Complete Claim Form

Completing the pet insurance claim form accurately is a pivotal step in the reimbursement process. Whether online or in paper format, ensure all required fields are filled with precise information. Clearly detail the incident, illness, or treatment, and attach any supporting documents, such as veterinary invoices and medical records. Accurate and thorough completion of the claim form expedites the processing time, minimizing potential delays. It’s essential to provide all necessary details to help the insurer assess the claim efficiently and ensure that you receive timely reimbursement for eligible expenses outlined in your pet insurance policy.

Submit Claim

Once you’ve completed the pet insurance claim form and gathered all necessary documentation, submit your claim promptly to your insurance provider. Most insurers offer convenient online submission options, simplifying the process. Ensure that all required documents are attached and submitted through the specified channels, whether online portals, email, or traditional mail. Timely submission enhances the efficiency of the claims process, expediting the assessment and approval of your claim. Staying proactive in this step contributes to a smoother experience, allowing you to receive reimbursement for covered expenses outlined in your pet insurance policy within the designated timeframes.

Follow Up

After submitting a pet insurance claim, proactive follow-up is essential. Stay informed about the status of your claim by utilizing online portals or contacting the insurer’s customer service. Regularly check for updates on the processing status and estimated timeframes for reimbursement. If there are any delays or additional information is required, follow up promptly to address any issues. Clear communication and diligence in monitoring the progress of your claim ensure that you remain informed throughout the reimbursement process. This approach helps maintain transparency, allowing you to address any concerns or provide necessary details, ultimately expediting the resolution of your pet insurance claim.

Reimbursement

Upon approval, reimbursement is the final step in the pet insurance claims process. The insurer will issue payment for eligible expenses, deducting any applicable copayments or deductibles as specified in your policy. Reimbursement is typically made through direct deposit or check, depending on your chosen method. Promptly review the reimbursement details to ensure accuracy and completeness. Understanding the reimbursement process and being aware of any deductions helps you manage your finances effectively. Keep records of the reimbursement transactions for your records, maintaining a comprehensive overview of your pet’s healthcare expenses and the financial support provided by your pet insurance policy.

Understand Denials

In the event of a denied pet insurance claim, carefully review the reasons provided by the insurer. Understand the specific policy terms, exclusions, or documentation issues that led to the denial. Communicate with the insurer to seek clarification or address any discrepancies promptly. If necessary, provide additional information or rectify any issues cited in the denial. Clear comprehension of the denial reasons allows you to make informed decisions about your next steps, whether it involves adjusting future claims or making necessary changes to your pet insurance coverage. Open communication with the insurer facilitates a transparent and collaborative resolution process.

By following these steps and maintaining clear communication with your insurance provider, you can navigate the claims process effectively and ensure that you receive the financial assistance outlined in your pet insurance policy.

Customer Testimonials

Customer testimonials serve as a vital tool for individuals considering pet insurance, offering firsthand perspectives on the experiences of current policyholders. These testimonials, often shared on the insurer’s website or other platforms, provide valuable insights into the effectiveness of the coverage and the overall satisfaction of pet owners. Positive testimonials typically highlight instances where the insurance company demonstrated promptness and reliability in processing claims, responsive customer service, and comprehensive coverage that met or exceeded expectations. These narratives can instill confidence in potential customers, showcasing real-world scenarios where the insurance made a tangible and positive impact on the well-being of pets.

Conversely, negative testimonials may draw attention to issues such as claim denials, perceived gaps in coverage, or challenges in communication with the insurer. Examining these less favorable experiences allows prospective policyholders to understand potential drawbacks and make informed decisions. It’s essential to consider the overall sentiment and frequency of positive versus negative testimonials to gauge the insurer’s overall performance.

Moreover, testimonials often shed light on the insurer’s commitment to customer satisfaction and their ability to handle unforeseen circumstances. Reading about how an insurance provider supported pet owners during unexpected medical emergencies or complex health situations can be particularly reassuring.

In essence, customer testimonials serve as a window into the real-world dynamics of pet insurance, offering potential policyholders valuable perspectives that extend beyond policy details. By leveraging these shared experiences, individuals can better align their expectations, make informed choices, and select a pet insurance provider that resonates with their priorities and requirements for comprehensive and reliable coverage for their beloved pets.

Pet Insurance for Exotic Pets

Securing pet insurance for exotic pets is a specialized and evolving facet of the insurance industry. Exotic pets, including reptiles, birds, and small mammals, require unique and often intricate healthcare. While some traditional pet insurance providers may extend coverage to exotic pets, there’s a growing recognition of the need for specialized insurers catering specifically to these non-traditional companions.

Policies for exotic pets typically cover veterinary expenses related to accidents, illnesses, and, in some cases, preventive care. However, due to the diverse range of exotic species, each with its distinct healthcare requirements, coverage specifics can vary widely.

Exotic pet insurance can be particularly beneficial in mitigating the financial impact of unforeseen medical expenses. This is crucial as the healthcare for exotic pets often involves specialized veterinary knowledge and can be associated with higher costs compared to more common domestic animals.

For those considering exotic pets, exploring available insurance options and understanding the specific needs of the chosen species are essential steps in promoting the well-being of these unconventional yet cherished members of the family. As the popularity of exotic pets continues to rise, it’s anticipated that the pet insurance industry will further adapt to meet the specific demands of this unique and diverse pet ownership landscape.

This may involve the development of more comprehensive and tailored coverage options for exotic species, ensuring that pet owners can provide the necessary healthcare for their unconventional companions without facing undue financial strain.

Trends in Pet Insurance

Several noteworthy trends have emerged in the realm of pet insurance, reflecting the evolving landscape of pet ownership and healthcare. One prominent trend is the increasing awareness and demand for pet insurance, driven by a growing recognition of pets as integral family members. As this awareness expands, more pet owners are seeking comprehensive coverage to ensure their pets receive optimal medical care without financial constraints.

Another notable trend is the rise of specialized coverage for specific breeds and species. Insurers are acknowledging the diverse healthcare needs of different breeds and types of pets, offering tailored policies to address these unique requirements. This trend caters to the increasing popularity of exotic pets, as well as the understanding that certain breeds may be predisposed to specific health issues.

Technological advancements have also influenced pet insurance trends, with the integration of digital platforms and mobile applications for streamlined claims processing and communication. Digital innovations not only enhance the efficiency of submitting and tracking claims but also contribute to a more seamless and user-friendly experience for pet owners.

Additionally, wellness-focused coverage is gaining traction, reflecting a shift towards proactive healthcare for pets. Some insurers now offer preventive care plans covering routine check-ups, vaccinations, and dental care. This trend aligns with the broader movement towards preventive medicine, emphasizing the importance of maintaining pets’ health to avoid potential issues.

The pet insurance industry is witnessing increased collaboration with veterinary clinics and healthcare providers. Partnerships between insurers and veterinary practices aim to simplify the claims process, improve communication, and enhance the overall experience for pet owners seeking medical care for their animals.

The trends in pet insurance reflect a dynamic landscape shaped by the evolving perceptions of pet ownership, technological innovations, and a growing emphasis on tailored and preventive healthcare. As these trends continue, pet insurance is likely to become even more nuanced and responsive to the diverse needs of pet owners and their cherished companions.

Tips for Keeping Premiums Low

- Start Early: Enroll your pet in insurance while they’re young and healthy. Premiums tend to be lower for younger animals, and pre-existing conditions won’t impact costs.

- Choose a Higher Deductible: Opt for a higher deductible to reduce monthly premiums. While you’ll pay more out-of-pocket in the event of a claim, this can significantly lower your regular insurance costs.

- Select Basic Coverage: Tailor your coverage to essential needs. Choosing a more straightforward plan that covers accidents and major illnesses can be cost-effective, especially if routine care expenses are manageable out-of-pocket.

- Maintain a Healthy Lifestyle: Keeping your pet healthy through regular exercise, a balanced diet, and preventive care can reduce the likelihood of illnesses, potentially lowering your long-term insurance costs.

- Compare Plans: Take the time to compare policies from different providers. Assess coverage limits, reimbursement rates, and customer reviews to find a plan that offers the best value for your specific needs.

- Consider a Wellness Plan: Some insurers offer separate wellness plans for routine care. While this adds an additional cost, it can help budget for preventive measures, avoiding unexpected expenses.

- Multi-Pet Discounts: If you have multiple pets, explore insurers offering discounts for insuring more than one animal. Bundling policies can often result in reduced premiums for each pet.

- Stay Informed: Regularly review your policy to ensure it aligns with your pet’s current health needs. Adjust coverage as necessary, avoiding unnecessary expenses for services your pet may no longer require.

- Ask About Discounts: Inquire about available discounts. Some insurers offer discounts for military service, multiple pets, or affiliations with certain organizations.

- Maintain Continuous Coverage: Avoid lapses in coverage to ensure continuous protection. Insurance providers may view gaps in coverage as a potential risk, affecting premium rates.

Future of Pet Insurance

The future of pet insurance appears to be marked by several notable trends and advancements, driven by the evolving landscape of pet ownership and the broader insurance industry. As more people consider pets integral members of their families, the demand for comprehensive and specialized coverage is expected to rise. This trend is likely to drive innovation in policy offerings, with insurers focusing on more tailored plans to address the unique healthcare needs of specific breeds and species. The continued integration of technology is also anticipated, with the adoption of artificial intelligence and data analytics to streamline claims processing, enhance customer experiences, and personalize coverage based on individual pet health data.

Preventive care is likely to take center stage in the future of pet insurance. With a growing emphasis on wellness and proactive healthcare, insurers are expected to offer more comprehensive coverage for routine veterinary visits, vaccinations, and preventive treatments. This shift aligns with a broader trend in the healthcare industry towards preventing issues before they arise.

Collaborations between pet insurance providers and veterinary clinics are likely to increase, fostering better communication and coordination between the two entities. This collaboration could lead to more seamless claims processing and improved access to healthcare for pets. Additionally, partnerships with pet technology companies may result in innovative solutions, such as wearable devices that monitor a pet’s health and provide data for insurers to tailor coverage.

Environmental and lifestyle factors are also expected to influence pet insurance. As pet owners become more conscious of their pets’ environmental impact and dietary needs, insurers may offer coverage options that align with eco-friendly practices and specialized diets, reflecting a broader societal shift toward sustainable living.

FAQs

Is it possible to insure a pet?

Pet insurance is a form of insurance that is often overlooked by pet owners. But, it can help save you from unexpected costs when your cat or dog has an emergency. Pet Insurance is a health care policy for your pet that will provide payment.

What insurance do you need for a dog?

Owners can choose from two different types of dog health insurance coverage: Accident & Illness and Accident-Only. Accident and illness plans cover injuries in addition to illnesses such as arthritis, hypothyroidism, cancer, ear infections, UTIs, and digestive issues.

Does pet insurance cover all pets?

Some insurers will allow you to add multiple pets to one policy, though most may require you to buy separate policies for each pet instead. Note that many pet insurance companies will only provide coverage for cats and dogs, so you may be out of luck with other pets like birds, hamsters, snakes, and rabbits.

What happens to pet insurance when a pet dies?

Most insurers will have an online cancellation form in which you can update them. This will allow your insurer to refund you for the time left on your coverage from when your pet passed away. It will also prevent your policy from continuing into the future and resulting in additional payments.

Does pet insurance cover food?

The unfortunately vague answer is “sometimes.” Prescription food isn’t covered by most providers, but you can find it in some plans. Pet insurance policies are generally more useful for covering unexpected accidents or illnesses and the diagnostics and exam fees that result.

Conclusion

Pet insurance is available from a variety of sources, including traditional insurance companies, specialized pet insurance providers, and veterinary clinics. It’s essential for pet owners to explore different options, compare policies, and choose coverage that aligns with their pet’s specific needs and their budget. With a range of providers offering diverse plans, finding the right pet insurance is a personalized process that ensures comprehensive protection for beloved animal companions.