In a No-Fault Accident Who Pays In 2024 | Comprehensive Guide?

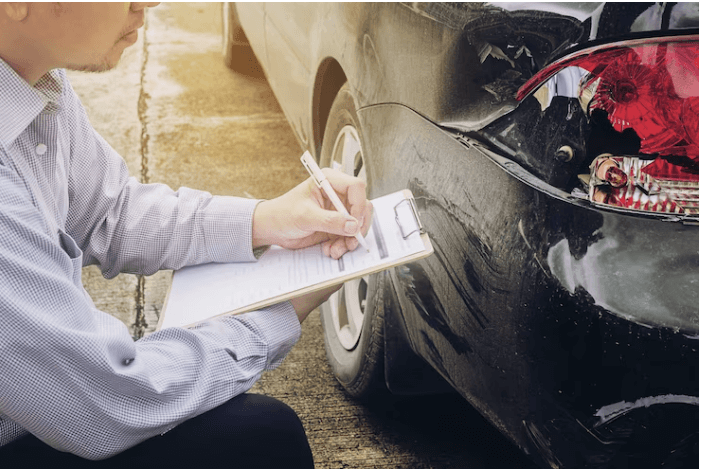

In the fast-paced world of traffic and unforeseen incidents, the term “no-fault accident” has become a common yet often misunderstood phrase. When a collision occurs, it’s natural to wonder who bears the financial responsibility, especially in situations deemed as “no-fault.” In this article, we’ll delve into the intricacies of these accidents, exploring the nuances of insurance coverage, the primary payer, exceptions, a No-Fault Accident Who Pays?, and the broader implications on those involved.

Contents

Understanding No-Fault Accidents

A no-fault accident refers to a situation in which each party involved in a collision is responsible for their own damages and injuries, regardless of who caused the accident. In a no-fault system, individuals typically rely on their own insurance to cover medical expenses and property damage rather than pursuing claims against the at-fault party.

This approach aims to streamline the claims process, reduce litigation, and ensure that individuals promptly receive compensation from their own insurance providers, regardless of fault, fostering quicker resolution and easing the burden on the legal system.

Definition and Characteristics

A paragraph typically consists of a group of sentences focused on a central idea. In the context of writing, a paragraph is a structural unit that helps organize and convey information. It usually begins with a topic sentence that introduces the main point, followed by supporting sentences that provide details, examples, or explanations. A concluding sentence may summarize the key points or transition to the next paragraph.

Differentiating from At-Fault Accidents

In the context of vehicular accidents, distinguishing between at-fault and no-fault incidents is crucial in determining liability and insurance claims. In at-fault accidents, one party is identified as primarily responsible for the collision, and their insurance typically covers the damages and medical expenses. This determination is often based on factors such as traffic rule violations or negligence.

Insurance Coverage in No-Fault Accidents

In a no-fault accident, insurance coverage functions differently than in traditional fault-based systems. In no-fault states, each party’s insurance typically covers their own medical expenses and related costs, regardless of who caused the accident. This system aims to streamline the claims process and ensure prompt payment for medical bills and other damages, reducing the need for lengthy legal battles to determine fault.

How PIP Coverage Works

Personal Injury Protection (PIP) coverage is a type of auto insurance that provides medical expense and, in some cases, wage loss coverage for policyholders and their passengers, regardless of who is at fault in an accident. PIP is designed to cover medical costs, rehabilitation expenses, and even lost wages resulting from injuries sustained in a car accident.

Primary Payer in No-Fault Accidents

In no-fault accidents, the primary payer for medical expenses and other related costs is typically the insurance company of the individuals involved in the accident. Unlike traditional liability-based systems, where the at-fault party’s insurance covers the damages, in a no-fault system, each party’s insurance covers its own expenses regardless of who caused the accident. This approach aims to streamline the claims process, reduce legal disputes, and ensure prompt compensation for accident-related costs. However, the specifics can vary by jurisdiction, and individuals involved may still pursue legal action under certain circumstances.

Role of Your Own Insurance Company

As an insurance company, our primary role is to provide financial protection and risk management to our policyholders. We offer a diverse range of insurance products, including auto, home, health, and life insurance, tailored to meet the unique needs of our customers. In the event of covered losses or unforeseen circumstances, we aim to indemnify and support our policyholders, helping them recover and mitigate the financial impact.

Limits and Coverage Details

The concept of “Limits and Coverage Details” pertains to the boundaries and extent of certain parameters or conditions within a given context. In various fields such as insurance, finance, or technology, understanding the limits and coverage details is crucial for making informed decisions. Limits refer to the maximum or minimum values that define the scope of a particular policy, service, or agreement, while coverage details outline the specific inclusions and exclusions within that scope.

Exceptions to No-Fault Coverage

No-fault coverage in insurance is designed to provide compensation for injuries and damages without requiring the determination of fault. However, there are certain exceptions to this rule. In some cases, intentional and criminal acts may not be covered under no-fault insurance. For example, if a policyholder deliberately causes an accident or engages in criminal activity that leads to a claim, the insurance company may have grounds to deny coverage.

Circumstances Where Someone Else May Be Liable

In various circumstances, individuals or entities may be held liable for certain actions or outcomes. For instance, if someone is injured on another person’s property due to negligence in maintaining a safe environment, the property owner may be held liable for the injuries. Similarly, in the realm of business, if a company produces and sells a defective product that causes harm to consumers, the manufacturer could be held legally responsible for the damages incurred.

Determining Fault in Special Cases

Determining fault in special cases can be a complex process that requires careful consideration of unique circumstances. In scenarios where standard rules may not directly apply, a nuanced approach is essential. For instance, when dealing with highly intricate systems or emerging technologies, fault determination may involve interdisciplinary expertise and an in-depth analysis of specific industry standards.

Coordination of Benefits

Coordination of Benefits (COB) is a process used in the insurance industry to determine the order in which multiple insurance policies covering the same individual will pay claims. The goal is to avoid overpayment and ensure that the total benefits received do not exceed the actual expenses incurred. When an individual is covered by more than one insurance plan, such as through dual coverage from both a primary and secondary insurer, COB helps establish the primary payer responsible for initial claim settlements.

How Multiple Insurance Policies Interact

When an individual holds multiple insurance policies, it’s crucial to understand how these policies interact to ensure comprehensive coverage and avoid potential gaps or overlaps. Insurance policies generally fall into different categories such as health, auto, home, life, and more. Each type of insurance serves a specific purpose, and the interaction between policies depends on the nature of the coverage.

Firstly, coordination of benefits is essential, particularly in health insurance. When an individual has coverage under more than one health insurance plan, the policies must coordinate to determine the primary and secondary payers. This coordination helps in maximizing the benefits while avoiding overpayment. the interaction between policies depends on the nature of the coverage.

Secondly, in the realm of property and casualty insurance, such as home and auto insurance, overlapping coverage can lead to confusion. For instance, if both home and auto policies cover personal property, there might be a need to clarify which policy takes precedence in the event of a covered loss involving personal belongings in a car.

Life insurance policies may also interact in the context of beneficiaries. If an individual has multiple life insurance policies, it’s essential to ensure that the designated beneficiaries are clearly outlined to avoid disputes or delays in the event of a claim.

Furthermore, some insurance policies offer riders or endorsements that can be added to enhance coverage. Understanding how these additions interact with other policies is crucial for optimizing protection and avoiding redundancies.

Coverage for Medical Bills and Treatments

Firstly, health insurance plays a pivotal role in determining the extent of coverage for medical bills. Many individuals rely on health insurance plans provided by employers or purchased independently. These plans typically cover a range of medical services, including hospital stays, surgeries, prescription medications, and preventive care. However, the specifics of coverage can differ, and individuals must carefully review their insurance policies to understand the limitations, copayments, and deductibles associated with various medical treatments.

Furthermore, certain medical treatments or services may not be covered by insurance, leading to additional financial burdens for individuals. Cosmetic procedures, experimental treatments, or elective surgeries may fall outside the scope of insurance coverage, necessitating private payment. Additionally, some insurance plans may have limitations on specific medications or therapies, requiring individuals to explore alternative options or incur additional expenses.

Property Damage in No-Fault Accidents

In no-fault accident systems, which are designed to streamline the claims process and provide prompt compensation regardless of fault, the handling of property damage differs from the traditional fault-based insurance model. In such systems, each party involved in an accident typically seeks compensation from their own insurance company, regardless of who caused the collision.

Firstly, in a no-fault system, the focus is primarily on personal injury claims rather than property damage. This means that insurance coverage for property damage may be limited, and individuals might need to rely on their collision coverage or other optional insurance provisions to address the costs associated with damage to their vehicle or other property.

Secondly, the process of resolving property damage claims in a no-fault system is generally faster and less contentious. Since fault is not a determining factor, individuals can swiftly file a claim with their own insurance company and receive compensation for property damage without protracted negotiations or litigation.

However, it’s essential to note that the compensation for property damage in no-fault systems may have limits, and coverage might not extend to certain types of damage or specific circumstances. Individuals should carefully review their insurance policies to understand the scope of property damage coverage and whether additional coverage options are necessary to fully protect their assets.

FAQs about In a No-Fault Accident Who Pays?

What to do in a non-fault accident?

In a non-fault accident, gather evidence, exchange information with the other party, and report the incident to both your insurer and the at-fault party’s insurer. Seek medical attention if needed, and document the damages.

Can I claim that the accident was my fault?

Yes, you can still claim that the accident was your fault. Your insurance will cover your expenses, but you may need to pay the excess, and your premium is likely to increase at renewal.

How long does it take to settle a non-fault claim?

The time to settle a non-fault claim varies. It can take weeks to months, depending on the complexity of the case, the responsiveness of involved parties, and the insurance companies involved.

How much does insurance increase after a claim?

The increase in insurance premiums after a claim varies. It depends on factors like the severity of the accident, your driving history, and the policies of your insurance company. Expect a higher premium at renewal.

How do insurance companies work out who is at fault?

Insurance companies determine fault based on evidence, witness statements, police reports, and applicable laws. They may use adjusters and follow established guidelines to allocate responsibility for an accident.

Conclusion

It is evident that our journey through various topics has unveiled the complexity and interconnectedness of the world around us. From exploring scientific advancements and technological breakthroughs to delving into philosophical inquiries and societal challenges, the vast tapestry of human knowledge continues to expand. As we navigate this ever-evolving landscape, it becomes increasingly crucial to foster curiosity, critical thinking, and a collaborative spirit. Embracing diversity, innovation, and ethical considerations will undoubtedly shape a more sustainable and harmonious future. Our collective responsibility lies in harnessing the power of knowledge to address global issues, inspire positive change, and foster a shared understanding that transcends borders and boundaries.